The Looming Assault on Prop 13: Why California Homeowners Should Be Alarmed by Gavin Newsom and Democrats' Latest Moves – August 2025 Update

The Looming Assault on Prop 13: Why California Homeowners Should Be Alarmed by Gavin Newsom and Democrats' Latest Moves – August 2025 Update

Darel Ison here – the no-BS real estate guy from Abundant Path Homes, where we've been guiding San Diego families through the ups and downs of the housing market. If you've been following my updates, you know I call it like I see it, especially when it comes to threats that could upend your biggest investment: your home. Last month, I warned about the ongoing efforts by Governor Gavin Newsom and California Democrats to chip away at, and potentially repeal, Proposition 13. Since then, the plot has thickened with new campaigns, voter backlash on related issues, and whispers of even bolder power grabs. This isn't just political noise; it's a direct attack on homeowners that could lead to skyrocketing property taxes, forced sales, and a full-blown affordability crisis. With a potential 2026 ballot measure to gut Prop 13 still brewing and fresh developments in July and August 2025, the time to act is now. Let's revisit the basics, update on the latest threats, and discuss what you can do to fight back.

A Quick Refresher: Why Prop 13 Is the Lifeline for California Homeowners

Passed overwhelmingly by voters in 1978, Proposition 13 was a game-changer. It capped property taxes at 1% of a home's assessed value at the time of purchase and limited annual increases to no more than 2% until the property is sold. This protected generations of Californians – especially seniors on fixed incomes and middle-class families – from being taxed out of their homes as property values soared. Without it, imagine your tax bill doubling or tripling overnight just because your neighborhood got hot. Prop 13 has been the shield against runaway government spending, but for years, Democrats in Sacramento have viewed it as a "subsidy" ripe for the picking, as the San Francisco Chronicle recently framed it in a January 2025 piece. They've tried before – remember the failed Prop 15 in 2020, backed by Newsom and unions, which aimed to strip protections from commercial properties? That was just the start. And don't forget Prop 19 in 2020, which, under the guise of funding firefighters during COVID, gutted Prop 13's inheritance protections for family transfers – now forcing many heirs to pay market-rate taxes on homes passed down, leading to bills jumping from a few thousand to tens of thousands annually.

The 2025 Update: Stealth Attacks, a Brewing 2026 Repeal Push, and New Developments Since July

Fast-forward to mid-2025, and the threats are escalating. While Newsom's high-profile housing reforms signed in June – like AB 130 and SB 131 – focus on building more units and streamlining permits, they conveniently sidestep the elephant in the room: funding these ambitions without touching Prop 13. But dig deeper, and the picture gets grim. Recent reports and social media buzz from local watchdogs reveal Democrats, in cahoots with labor unions, are gearing up for a full repeal of Prop 13 on the 2026 ballot. That's right – they're plotting to remove the caps that keep your taxes predictable and affordable.

Already this year, we've seen nine separate bills introduced by Democrats to hike property taxes in various ways, including a punishing 5% transfer tax on every home sale, piled on top of capital gains. This comes on the heels of California Supreme Court rulings that have already weakened Prop 13, like the 2020 Uplands decision lowering vote thresholds for special taxes and a 2024 block on a taxpayer protection initiative. In response, Republican Assemblyman Carl DeMaio introduced ACA 14 in April 2025 to reinforce Prop 13 and restore voter rights, but with Democrats controlling the legislature, it's an uphill battle.

Newsom's fingerprints are all over this. His administration's budget proposals include payroll tax hikes that indirectly pressure property owners, and there's talk of tying housing funds to relaxed tax rules. Critics like the Howard Jarvis Taxpayers Association warn that repealing Prop 13 would unleash billions in new revenue for Sacramento – at your expense. And with the Chronicle labeling Prop 13 benefits as "subsidies" that cost local governments revenue, the narrative is shifting to paint homeowners as the problem.

Since my July article, the resistance has ramped up. In late July 2025, Carl DeMaio launched a new campaign through Reform California to protect Prop 13 and stop property tax hikes, warning that Sacramento politicians have launched an "all-out assault" to repeal it potentially as soon as November 2025. This comes amid ongoing backlash over Prop 19's lingering effects, with families still reeling from lost inheritance protections – one critic called it "outright theft," as multi-million-dollar homes now face $50,000+ annual tax bills instead of $3,000-4,000.

Adding fuel to the fire, Newsom's disregard for voter-approved measures has been on full display. In July and August 2025, he faced widespread criticism for refusing to fully fund Prop 36 – the 2024 ballot initiative that toughened penalties for repeat theft and drug offenses, passing with over 68% support to reverse parts of the disastrous Prop 47. Despite overwhelming approval, Newsom called it an "unfunded mandate" and shifted costs to local governments, prompting accusations of gaslighting voters and undermining democracy. This pattern raises alarms: if he ignores Prop 36, what's stopping him from targeting Prop 13 next?

Meanwhile, Newsom's July 2025 push for a special $250 million election to overhaul the Citizens Redistricting Commission – potentially allowing Democrats to redraw maps mid-decade and reduce Republican congressional seats to just three out of 52 – has sparked fears of a broader power grab. Some watchdogs speculate this could "sneak in" changes to weaken Prop 13, tying it to his anti-Trump rhetoric about "fighting fire with fire." Reform California continues to rally against these "tax hikes," urging voters to defeat any 2026 repeal efforts.

The Doom and Gloom: What a Prop 13 Repeal Means for You

If these efforts succeed, the fallout for homeowners would be catastrophic. Property taxes could explode – reassessments at full market value could mean bills jumping from a few thousand to tens of thousands annually for long-time owners. Seniors who've paid off their mortgages might be forced to sell and downsize, or worse, leave the state entirely. Families scraping by in high-cost areas like San Diego would face impossible choices: pay up or pack up.

Rents? They'd skyrocket too, as landlords pass on higher taxes to tenants, worsening the affordability crisis Newsom claims to be fixing. We've already seen how past attempts like Prop 15 failed, but the push persists. Recent critiques highlight Prop 13's role in intergenerational wealth gaps, but repealing it would only exacerbate inequality by driving out middle-class families. Add Newsom's track record – $24 billion on homelessness with no results, $14.4 billion on a high-speed rail to nowhere – and it's clear: more taxes mean more waste, not solutions.

The latest blows? Newsom's opposition to gun safety reforms was overturned in July 2025 when the 9th Circuit ruled his Prop 63 ammo background checks unconstitutional, another example of overreach. And with new bills like AB1333 potentially criminalizing self-defense, homeowner protections feel thinner than ever.

What Can You Do? Fight Back Now

Homeowners, don't sit this out. Every Californian has a role to play in protecting Prop 13. Here’s what you can do today to fight back:

-

Join the Resistance with Reform California: Sign up as a volunteer or contribute to Carl DeMaio’s campaign at Reform California to help organize grassroots efforts, spread awareness, and defeat any 2026 repeal attempts. DeMaio’s “Stop the Tax Hikes” campaign is mobilizing voters to protect Prop 13 and block tax hikes.

-

Contact Your State and Local Representatives: Reach out to your state senator, assembly member, and local officials to demand they support ACA 14 and oppose any efforts to repeal Prop 13. You can find your representatives’ contact information at findyourrep.legislature.ca.gov. Urge them to stand with homeowners and reject tax hikes.

-

Support Taxpayer Advocacy Groups: Back organizations like the Howard Jarvis Taxpayers Association, which are fighting to preserve Prop 13. Visit hjta.org to donate or get involved.

-

Vote in Every Election: Participate in any special elections, like the proposed redistricting vote, and hold Newsom accountable at the ballot box. Stay informed about upcoming measures that could weaken Prop 13.

-

Spread the Word: Share this article and Reform California’s “Plain English” voter guide at ElectionGuideCalifornia.org with friends, family, and neighbors to educate them about the threat to Prop 13.

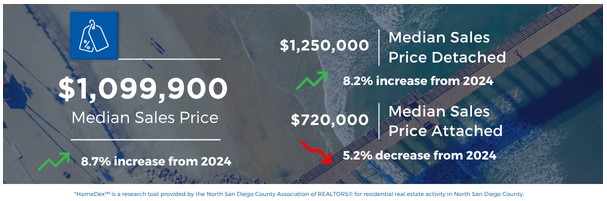

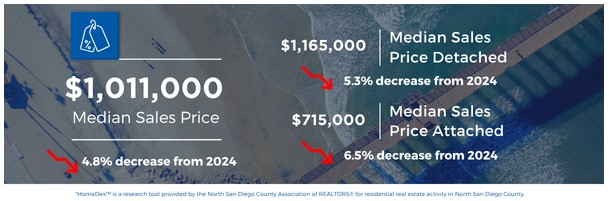

California is already one of the least affordable states, with only 17% of households able to afford the median home priced at around $847,000, and average rents in cities like San Diego at $3,131 and San Francisco at $3,522 eating up over 40% of many residents' incomes. Repealing Prop 13 would collapse the economy entirely, driving out the middle class as well as more businesses – higher property taxes on commercial properties would force companies to relocate to lower-tax states, resulting in massive job losses and reduced economic activity. This would make home ownership only for the rich, as skyrocketing tax bills would render properties unaffordable for middle-class families and seniors, who would be compelled to sell or abandon their homes, leaving only those with immense wealth able to absorb the costs. Ultimately, it would create a two-class society in California, with a tiny elite of affluent individuals and a large underclass mired in poverty, mirroring the economic divides in Venezuela and Cuba where government policies have eroded the middle class, leading to widespread inequality and social unrest. Only the richest would survive in a state where homeownership and renting become luxuries reserved for the 1%. Stay vigilant, San Diego – your home and California's future depend on it.

For more real estate insights and to join the fight, visit Abundant Path Homes or follow us on social media. Let's protect what's left of the California dream.

Categories

Recent Posts