Guide for Young Adults to Own a Home in SoCal: A 3-5 Year Plan

Guide for Young Adults to Own a Home in SoCal: A 3-5 Year Plan

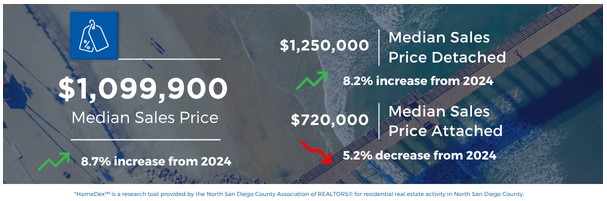

As a San Diego Realtor and National Real Estate Investor, I’m passionate about helping young adults just out of high school or college take actionable steps toward owning a home in Southern California’s competitive housing market within the next 3–5 years. With median home prices in San Diego hovering around $901,022 to $1,015,000 in 2025, the path to homeownership may seem daunting, but with strategic planning, discipline, and smart financial habits, it’s achievable. This step-by-step guide draws inspiration from popular real estate strategies in books like Rich Dad Poor Dad by Robert Kiyosaki and Set for Life by Scott Trench, tailored for SoCal’s unique market. Whether you’re living with parents to save money or exploring creative strategies like house hacking, here’s how to prepare.

Disclaimer: This guide provides general financial education and real estate strategies. It is not investment advice. Always consult with a licensed financial advisor, tax professional, or real estate professional before making investment decisions.

Step 1: Assess Your Financial Starting Point

Before diving into homeownership, understand your current financial situation to set realistic goals.

- Evaluate Income and Expenses: Track your monthly income (from jobs, side hustles, or internships) and expenses (phone, subscriptions, dining out). Use apps like Mint or YNAB to identify areas to cut spending.

- Check Your Credit Score: A strong credit score (700+) will secure better mortgage rates. Obtain a free credit report from AnnualCreditReport.com and address any errors or delinquencies. Pay down credit card balances and avoid late payments.

- Set a Savings Goal: In SoCal, an FHA loan requires a 3.5% down payment on a $900,000 home, which is $31,500, plus 2–5% for closing costs ($18,000–$45,000). Aim to save $60,000–$100,000 over 3–5 years, factoring in emergency funds and moving costs. If eligible for a VA loan through military service (see Step 6), you could potentially buy with 0% down, reducing your savings goal.

- Create a Timeline: Break your goal into monthly savings targets. For $80,000 in 4 years, save $1,667/month. Adjust based on your income and loan type.

Tip: If you’re fresh out of high school or college, consider low-cost community college or trade programs to boost earning potential without heavy student debt, preserving funds for your home purchase.

Step 2: Live Frugally to Save Aggressively

Living with your parents or minimizing housing costs is a powerful way to accelerate savings, a strategy championed in Set for Life for building wealth early.

- Stay with Parents: If possible, live rent-free or pay minimal rent to your parents. In SoCal, average rent for a one-bedroom apartment in San Diego is $2,300/month. Saving this amount could yield $82,800 over 3 years or $138,000 over 5 years.

- Alternative Low-Cost Housing: If living at home isn’t an option, share an apartment with roommates or rent a room in a less expensive area like El Cajon or National City, where rents can be $1,200–$1,800/month.

- Cut Lifestyle Costs: Limit discretionary spending (e.g., dining out, entertainment). Cook at home, use public transit or a bike instead of owning a car, and shop secondhand for clothes or furniture.

- Side Hustles: Boost income with part-time gigs like freelancing, tutoring, ridesharing, or getting a sales job. Sales roles, such as working for Cutco selling kitchenware or making calls for a local realtor like Abundant Path Homes, can pay $20–$50/hour or more with commissions. In SoCal, opportunities in tourism, tech, or real estate sales can yield high returns. Dedicate extra earnings to your home savings fund.

- Benefits of Learning to Sell: Mastering sales skills is invaluable, no matter your future career. Sales teaches you persuasion, negotiation, and resilience—skills critical for entrepreneurship, job interviews, or even advocating for a raise. For example, selling Cutco hones your ability to build rapport and close deals, while working on the phones for Abundant Path Homes sharpens your ability to generate leads and communicate value. These skills translate to any profession, from marketing to medicine, and can boost your confidence in navigating the homebuying process.

Rich Dad Poor Dad Insight: Focus on acquiring assets (like savings for a home) rather than liabilities (like car loans or credit card debt). Treat your savings as a non-negotiable “bill” to prioritize wealth-building.

Step 3: Build a Strong Financial Foundation

A solid financial base will prepare you for mortgage approval and unexpected expenses.

- Emergency Fund: Save 3–6 months of living expenses ($6,000–$12,000 for most young adults) in a high-yield savings account to avoid dipping into your down payment fund.

- Pay Off High-Interest Debt: Eliminate credit card debt or personal loans with interest rates above 7%. Avoid new debt, as lenders will scrutinize your debt-to-income (DTI) ratio (ideally below 36%).

- Open a High-Yield Savings Account: Store your down payment and emergency fund in an account earning 4–5% interest, like those offered by Ally or Marcus, to grow your savings safely.

- Start a Budget: Use the 50/30/20 rule: 50% for needs (rent, food), 30% for wants, and 20% for savings/debt repayment. Adjust to prioritize saving 30–50% for your home goal.

- Consider Safe Investments: For long-term wealth-building beyond your emergency fund, investing in the S&P 500 through low-cost index funds (e.g., Vanguard’s VOO) is a relatively safe option for most, offering diversification and historical average returns of 7–10% annually. Avoid trying to time the market with individual stock picks, as this increases risk and often underperforms broad market indices. Tony Robbins’ Money: Master the Game and Unshakeable emphasize this strategy, advocating for consistent, low-cost index fund investments to build wealth steadily. However, investing in stocks carries risks, including potential losses, and is not guaranteed. Reminder: This is not financial advice; consult a financial advisor to assess suitability for your goals.

Set for Life Strategy: Scott Trench emphasizes “frugal living” to free up capital for investments. By minimizing expenses and maximizing savings, you’re laying the groundwork for real estate wealth.

Step 4: Explore Income-Boosting and Investment Options

Increasing your income and exploring low-risk wealth-building strategies can accelerate your path to homeownership. Rich Dad Poor Dad encourages thinking like an investor to make your money work for you.

- Upskill for Higher Pay: Invest in skills that boost earning potential, like coding bootcamps, real estate licensing, or certifications in SoCal’s thriving industries (tech, healthcare). A $10/hour raise could add $20,800 annually to your savings.

- Side Businesses: Start a small business, such as dog walking or social media management, leveraging SoCal’s pet-friendly and tech-savvy culture. Reinvest profits into your home fund.

- Investment Ideas (Not Advice):

- Index Funds/ETFs: Consider low-cost, diversified funds like Vanguard’s VTI or S&P 500 ETFs for long-term growth. A $10,000 investment at 7% annual return could grow to $13,000 in 4 years.

- Treasury Bonds or CDs: For safety, invest in 1–5-year Treasury bonds or certificates of deposit yielding 4–5%. These preserve capital while earning modest returns.

- Dividend Stocks: Explore stable, dividend-paying stocks for passive income, but diversify to reduce risk. Reinvest dividends to compound growth.

- Real Estate Crowdfunding: Platforms like Fundrise allow small investments in real estate projects. A $1,000 investment could provide exposure to property markets, though returns are not guaranteed.

Disclaimer: Investments carry risks, and past performance does not guarantee future results. Consult a financial advisor to assess suitability for your goals.

Rich Dad Poor Dad Tip: Kiyosaki advocates for financial education and passive income. Learn about investments through books, podcasts (e.g., BiggerPockets), or free online courses to make informed decisions.

Step 5: Learn Real Estate Investor Strategies

Books like Rich Dad Poor Dad and Set for Life popularize strategies to buy property with minimal upfront capital. These can be especially useful in SoCal’s high-cost market.

- House Hacking: Purchase a multi-unit property (duplex, triplex, or fourplex), a single-family residence (SFR), or a condo using an FHA loan with a 3.5% down payment (around $31,500 for a $900,000 property). For a multi-unit, live in one unit and rent out the others. For an SFR or condo, live in the property and rent out spare bedrooms to roommates. Example: A $900,000 triplex with two units rented at $2,000/month generates $4,000, or an SFR with two bedrooms rented at $1,200/month generates $2,400, offsetting a $4,500 monthly mortgage. A condo with one rented bedroom at $1,500/month can also reduce costs.

- SoCal Advantage: The region’s high rental demand (average rent $2,300 in San Diego) makes house hacking viable, especially in areas like North Park, City Heights, or near colleges like SDSU for room rentals.

- Considerations: Research landlord-tenant laws, SoCal’s rent control ordinances, and local regulations for renting rooms in condos (some HOAs restrict rentals). Factor in maintenance costs, tenant/roommate management time, and privacy trade-offs.

- Live-In Flip: Buy a fixer-upper, live in it for 2 years to qualify for capital gains tax exemptions, then sell for a profit. In SoCal, a $700,000 home renovated for $50,000 could sell for $850,000, netting a $100,000 gain after costs.

- SoCal Tip: Look for properties in up-and-coming areas like Logan Heights or Encanto, where renovation potential is high.

- Accessory Dwelling Units (ADUs): Buy a single-family home with space to build an ADU (granny flat). Rent the ADU for $1,500–$2,000/month to offset your mortgage. SoCal’s relaxed ADU regulations, especially in San Diego, make this a popular strategy.

- Example: A $900,000 home with a $1,800/month ADU rental reduces your effective housing cost, building equity faster.

Set for Life Insight: Trench advocates house hacking to achieve financial independence by reducing living expenses and building equity. Start small, live frugally, and scale up to larger properties.

Step 6: Prepare for the Homebuying Process

Get ready to navigate SoCal’s competitive market by building knowledge and relationships.

- Research Loan Options:

- FHA Loans: Require 3.5% down and allow lower credit scores (580+). Ideal for first-time buyers or house hacking.

- VA Loans: If you serve in the military (active duty, reserves, or National Guard), you may qualify for a VA loan with 0% down and no private mortgage insurance (PMI). Military service, even part-time through the Reserves or National Guard, can open this option. Check eligibility with the VA and explore Chapter 35 benefits for dependents (up to 36 months of educational support, per prior conversations).

- Conventional Loans: Need 5–20% down but offer flexibility for investment properties.

- CalHFA Programs: California’s first-time buyer programs offer down payment assistance for low- to moderate-income buyers.

- Get Pre-Approved: Meet with a lender 6–12 months before buying to secure a pre-approval letter, signaling to sellers you’re serious. In SoCal, pre-approval is critical in competitive neighborhoods like La Jolla or Point Loma.

- Work with a Realtor: Partner with a SoCal Realtor (like myself at Abundant Path Homes) familiar with first-time buyer programs and investor strategies. We can identify properties suited for house hacking or ADUs and negotiate in a seller’s market.

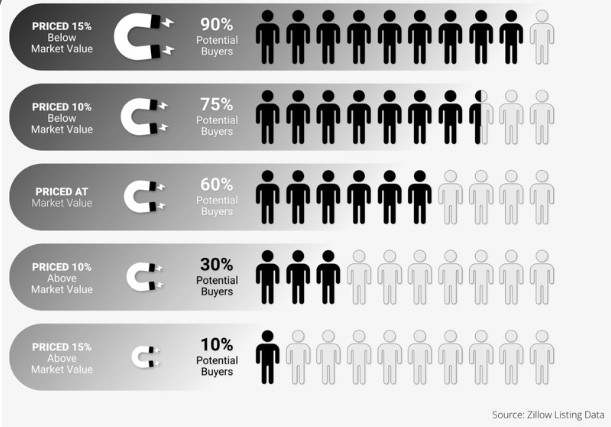

- Learn the Market: Follow local trends via Zillow, Redfin, or SoCal Housing Weekly. In 2025, San Diego’s inventory is up 39% (2,783 listings), and 37.4% of homes sell above asking, so focus on well-priced properties in emerging areas.

Tip: Attend free first-time homebuyer workshops hosted by San Diego County or HUD-approved agencies to learn about grants and local regulations.

Step 7: Build a Support Network

Surround yourself with professionals and mentors to guide your journey.

- Financial Advisor: Consult a fee-only advisor to review investment choices and savings plans.

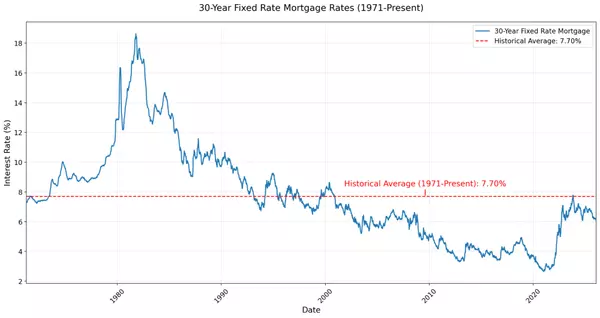

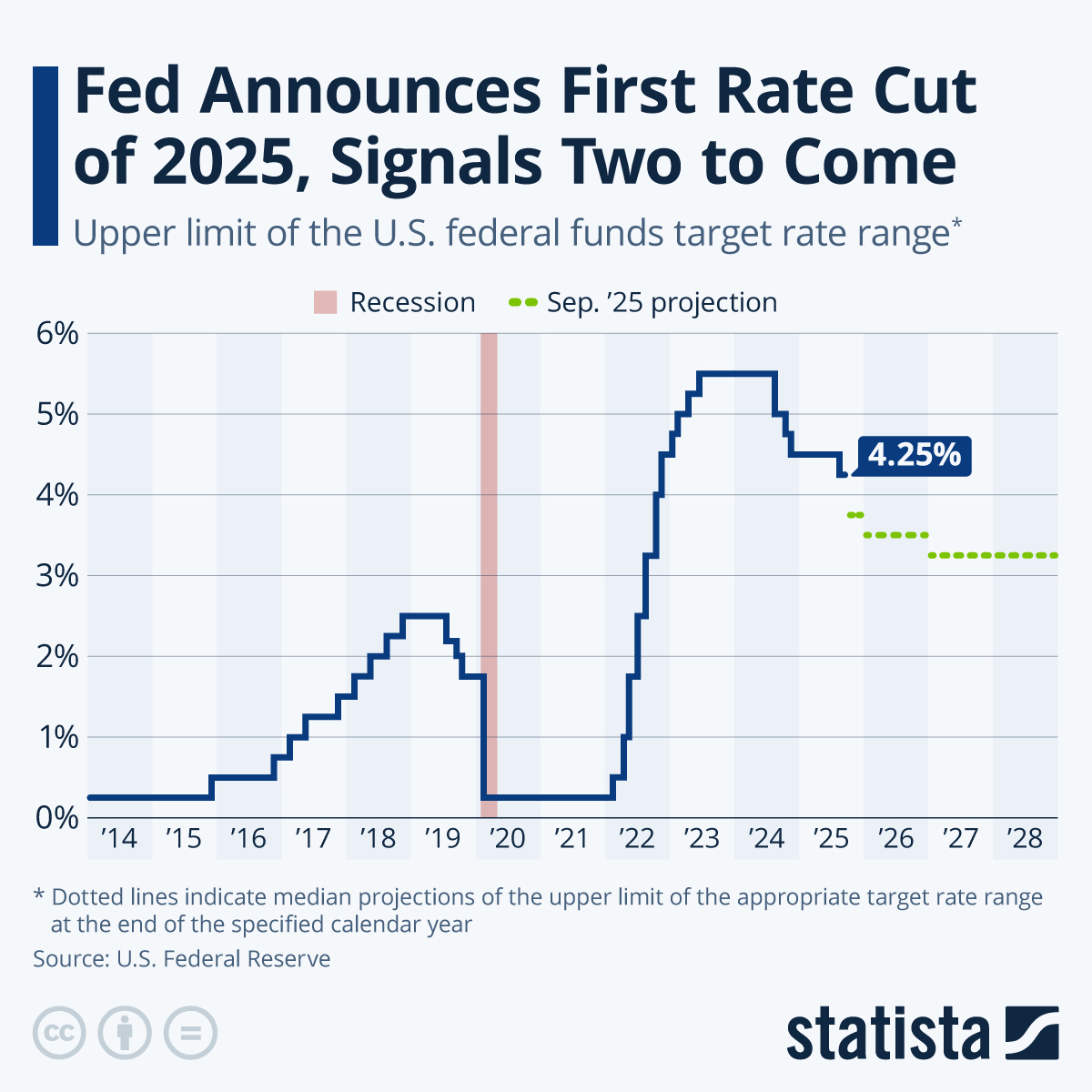

- Mortgage Broker: Shop multiple lenders to find the best rates and terms. In 2025, SoCal mortgage rates average 6.5–7%.

- Real Estate Mentor: Join local real estate investment groups like San Diego Real Estate Investors Association or BiggerPockets meetups to learn from experienced investors.

- Network with Peers: Connect with other young professionals saving for homes through social media groups or local events. Share tips and stay motivated.

Rich Dad Poor Dad Lesson: Kiyosaki emphasizes learning from mentors and taking calculated risks. Surround yourself with people who’ve achieved homeownership or real estate success.

Step 8: Stay Disciplined and Adapt

Homeownership in SoCal requires persistence and flexibility, especially with economic uncertainties like potential tariffs or rising rates (per 2025 forecasts).

- Track Progress: Review your savings and credit score quarterly. Adjust your budget if expenses creep up or income changes.

- Stay Informed: Monitor SoCal’s market trends. Zillow predicts 2.5–3.6% home value growth in San Diego by November 2025, but a 0.7% dip is possible by April 2026. Be ready to buy when opportunities arise.

- Avoid Lifestyle Creep: As your income grows, resist upgrading your car or apartment. Keep savings focused on your home goal.

- Plan for Setbacks: If job loss or unexpected costs occur, rely on your emergency fund and adjust your timeline without derailing your plan.

Set for Life Mindset: Trench stresses discipline and sacrifice in your 20s to achieve financial freedom. View short-term frugality as a trade-off for long-term wealth.

Conclusion: Your Path to SoCal Homeownership

Owning a home in Southern California within 3–5 years is challenging but achievable for young adults willing to live frugally, boost income, and leverage investor strategies like house hacking or ADUs. By living with parents, saving aggressively, and learning from books like Rich Dad Poor Dad and Set for Life, you can build the financial foundation needed to compete in this high-cost market. Military service can also unlock powerful options like VA loans, reducing your upfront costs. Start today by assessing your finances, cutting expenses, and connecting with a SoCal Realtor to guide your journey. For personalized advice or to explore properties suited for first-time buyers, contact me at Abundant Path Homes or follow local market updates via SoCal Housing Weekly.

Call to Action: Begin with one step this week—open a high-yield savings account, check your credit score, read a chapter of Set for Life, or contact Darel at 858-229-1625 or book a no-cost consultation at https://calendly.com/darel-abundantpathhomes/re to gain valuable insight into how you can achieve this goal. Small actions now will lead to big results in 3–5 years. Let’s make your SoCal homeownership dream a reality!

Categories

Recent Posts