Navigating the Government Shutdown: What It Means for Social Security, Military Families, and Veterans' Benefits

Navigating the Government Shutdown: What It Means for Social Security, Military Families, and Veterans' Benefits

By Darel Ison, Real Estate Investor and Realtor

As a real estate investor with 22 years of experience and a Realtor with 7 years in the field, I’ve seen how economic uncertainties—like the current federal government shutdown—can disrupt the financial plans of families and individuals. As of October 7, 2025, Congress’s failure to pass a funding bill has paused non-essential federal operations, leaving many concerned about their income streams. For those relying on Social Security, military pay, or VA benefits, the good news is that core payments are largely protected. However, disruptions to services could indirectly affect your ability to plan major decisions, like buying, selling, or investing in real estate.

In this article, I’ll break down the impacts on these key areas, drawing from official agency contingency plans and recent updates. Understanding these details can help you stay proactive—whether you’re budgeting for a mortgage, planning a real estate investment, or advising clients as a Realtor. Let’s dive in.

Social Security: Payments Secure, But Services May Lag

Social Security benefits, which support over 68 million retirees, disabled individuals, and survivors, are classified as mandatory spending funded through dedicated trust funds—not subject to annual appropriations. This means your monthly checks will continue without interruption, even during a shutdown. The Social Security Administration (SSA) has confirmed that payments for Social Security, Disability Insurance, and Supplemental Security Income (SSI) will arrive on schedule.

That said, the SSA will furlough about 15% of its workforce, leading to potential delays in non-essential services. Here’s a quick overview:

|

Service |

Impact During Shutdown |

|---|---|

|

Monthly Benefit Payments |

No change—continue as usual |

|

New Claims Processing |

Delayed; expect longer wait times |

|

Customer Service (Phone/Field Offices) |

Reduced staffing; increased hold times |

|

Cost-of-Living Adjustment (COLA) Announcements |

Possible postponement |

|

Online my Social Security Account |

Fully operational for self-service |

For real estate implications: If you’re a retiree considering a home purchase or an investor eyeing properties for seniors, delays in benefit verifications could slow loan approvals. Pro tip: Use the SSA’s online portal to gather documents early to keep transactions on track.

Military Pay: Duty Continues, But Paychecks May Pause

Active-duty service members, reservists, and National Guard personnel are the backbone of our national security, and the Department of Defense (DoD) prioritizes their operations during a shutdown. You’ll still report for duty and perform essential tasks, but pay for active-duty and reserve members could be delayed if the shutdown extends beyond the next payday (October 15, 2025). Congress often passes emergency legislation like the Pay Our Military Act to ensure timely compensation, as seen in past shutdowns.

Civilian DoD employees may face furloughs, but military personnel are exempt from that. Key details:

|

Category |

Impact During Shutdown |

|---|---|

|

Active-Duty & Reserve Pay |

Delayed until funding resumes; back pay guaranteed once resolved |

|

Military Retirement & Survivor Benefits |

Unaffected; funded separately |

|

Family Support Programs (e.g., Child Care) |

Limited; some on-base facilities may close |

|

Tricare Health Coverage |

Continues uninterrupted |

From a real estate perspective: Delayed pay could strain budgets for PCS (Permanent Change of Station) moves or VA home loans, impacting both homebuyers and investors targeting military communities. Military-friendly lenders like USAA or Navy Federal often offer no-interest advances—connect with them early if you’re relocating or financing a property.

VA Benefits: Core Support Intact, With Minor Service Hiccups

The Department of Veterans Affairs (VA) is a lifeline for millions, and its contingency plan ensures 97% of operations continue, safeguarding essential benefits. Compensation, pension, education (GI Bill), housing loans, and Dependency and Indemnity Compensation (DIC) payments will process and deliver as normal. Healthcare remains fully operational, with VA medical centers, clinics, and the Veterans Crisis Line (988, press 1) open 24/7.

However, outreach and administrative functions take a hit:

|

Service |

Impact During Shutdown |

|---|---|

|

Disability Compensation & Pension Payments |

No interruption; continue on schedule |

|

Healthcare Appointments & Hospitals |

Fully operational |

|

New Claims & Appeals Processing |

Continues, but regional offices closed to public |

|

Cemetery Maintenance & Pre-Need Burials |

Burials proceed; maintenance paused |

|

GI Bill Hotline |

Closed; use online portals instead |

For veterans in the housing market: VA loans remain active, but slower certificate processing could delay closings. Investors or Realtors working with veterans should file for adaptive housing grants early to avoid bottlenecks.

Broader Financial and Real Estate Ramifications

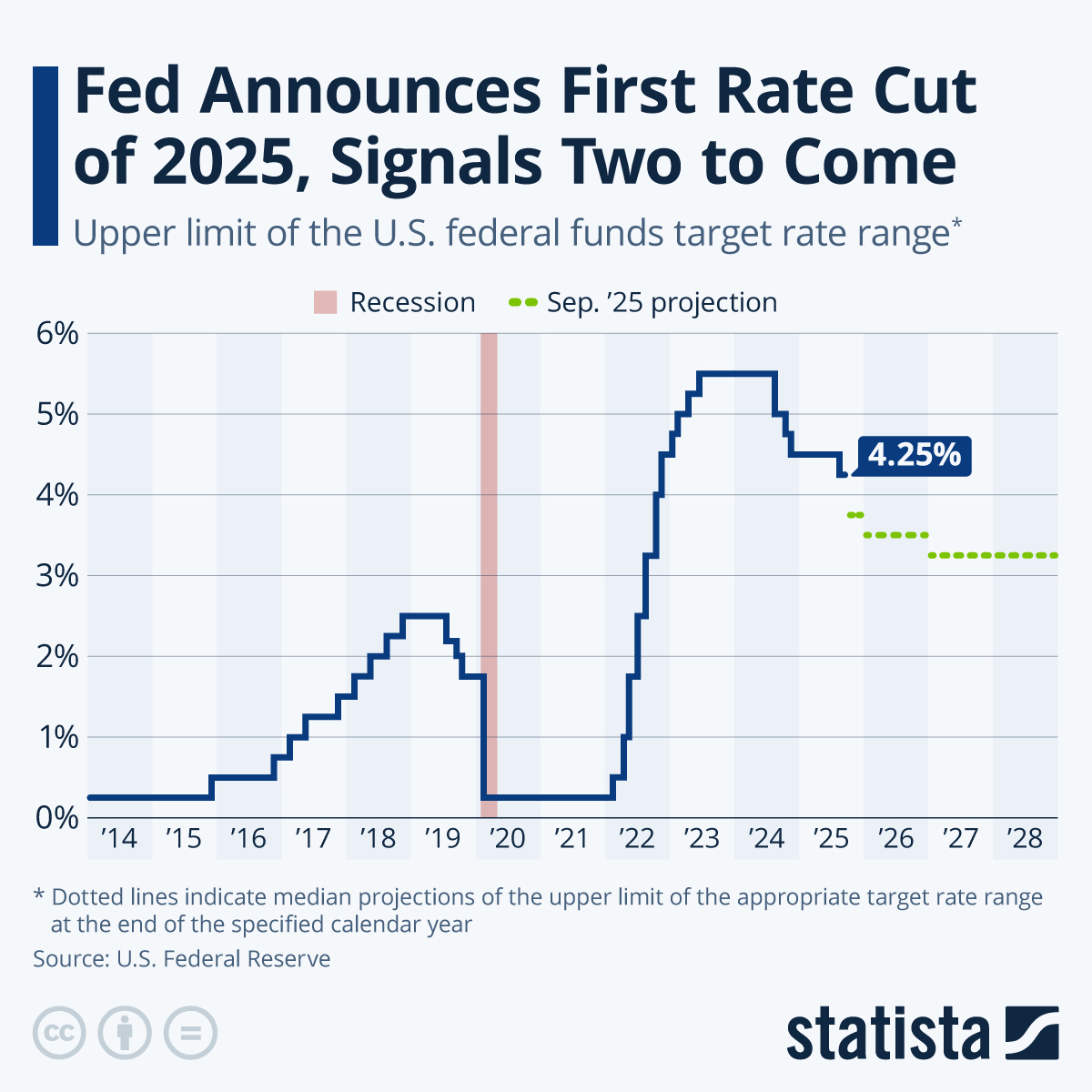

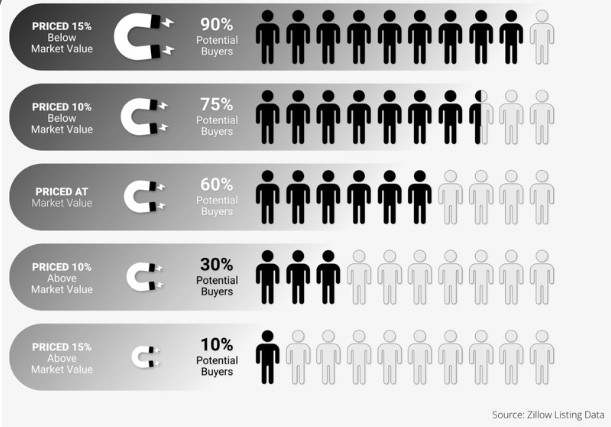

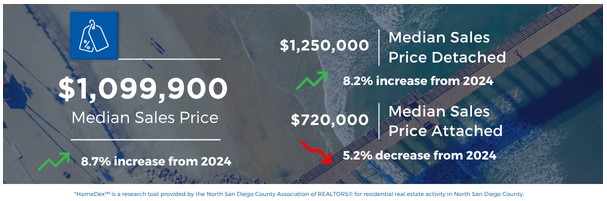

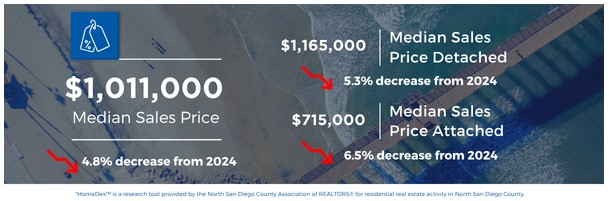

While direct payments hold steady, the shutdown’s uncertainty can shake confidence. Stock market dips might soften the housing sector, creating opportunities for investors to acquire properties at lower prices, but rising interest rates from fiscal concerns could reduce affordability for buyers. Military families facing PCS delays may need bridge loans, and seniors on fixed Social Security incomes should review emergency funds before listing a property.

My advice as your real estate investor and Realtor: Document everything now—pull credit reports, lock in rates if possible, and consult a financial planner. Shutdowns typically resolve within weeks, with retroactive pay, but preparation turns uncertainty into opportunity. For investors, now’s the time to scout deals; for buyers, secure pre-approvals to act fast.

Stay informed via official sources like SSA.gov, Defense.gov, and VA.gov. Whether you’re investing, buying, or selling, I’m here to guide you through this. Let’s keep your real estate goals on track.

Categories

Recent Posts