Is a Crash on the Horizon? San Diego & National Housing Market Analysis June 2025

Is a Crash on the Horizon? San Diego & National Housing Market Analysis June 2025

As a San Diego Realtor and National Real Estate Investor, I’ve closely examined the San Diego and national housing markets to assess whether a crash is looming in 2025. With high home prices, elevated mortgage rates, and shifting economic conditions, both buyers and sellers are understandably cautious. Below, I dive into the current state of the San Diego housing market, compare it to national trends, and evaluate the likelihood of a market crash based on available data and expert forecasts.

San Diego Housing Market: A Resilient but Cooling Market

San Diego’s housing market remains one of the most competitive and expensive in the United States, driven by its desirable coastal location, robust economy, and limited housing supply. As of mid-2025, key metrics paint a picture of a market that is cooling but far from collapsing:

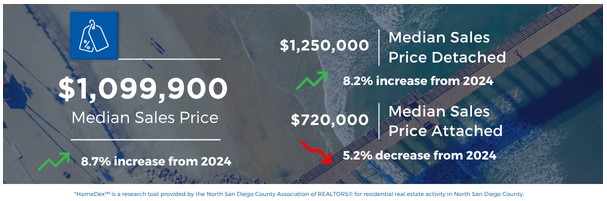

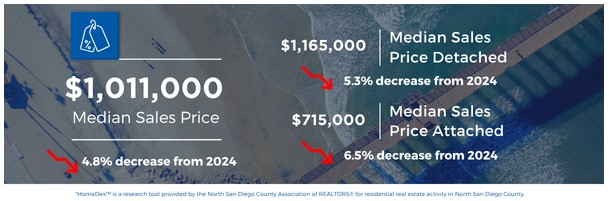

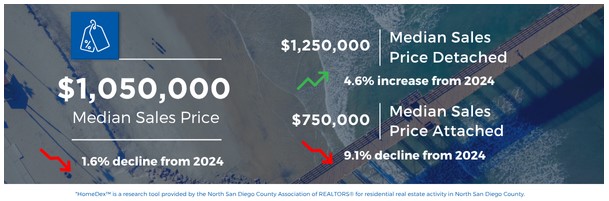

- Median Home Prices: The median home price in San Diego ranges from $901,022 to $1,015,000, significantly higher than the national median of $403,700. While prices have softened slightly (down 0.5% year-over-year in some reports), they remain elevated due to persistent demand and low inventory.

- Inventory Levels: Inventory has increased, with 2,783 active listings reported in mid-2025, up 39% to 71.2% from the previous year. This rise gives buyers more options, but the market still favors sellers, with a median sale-to-list ratio of 0.999.

- Days on Market: Homes are selling relatively quickly, averaging 21 to 37 days on the market, though this is slower than the frenetic pace of 2021–2022. Coastal and well-located properties often sell in as little as two weeks.

- Demand and Competition: Approximately 37.4% to 41% of homes sell above asking price, indicating continued competition, particularly for desirable single-family homes in central and coastal neighborhoods. However, bidding wars are less intense than in prior years.

Factors Driving San Diego’s Market

San Diego’s market is shaped by several structural and economic factors:

- Limited Housing Supply: Geographic constraints (ocean to the west, mountains to the east) and strict zoning regulations limit new construction, keeping inventory tight and supporting high prices.

- Strong Economy: San Diego’s diverse job market in technology, defense, tourism, and healthcare attracts professionals, fueling housing demand. The county added 61,600 jobs since October 2024, and the national unemployment rate is stable at around 4%.

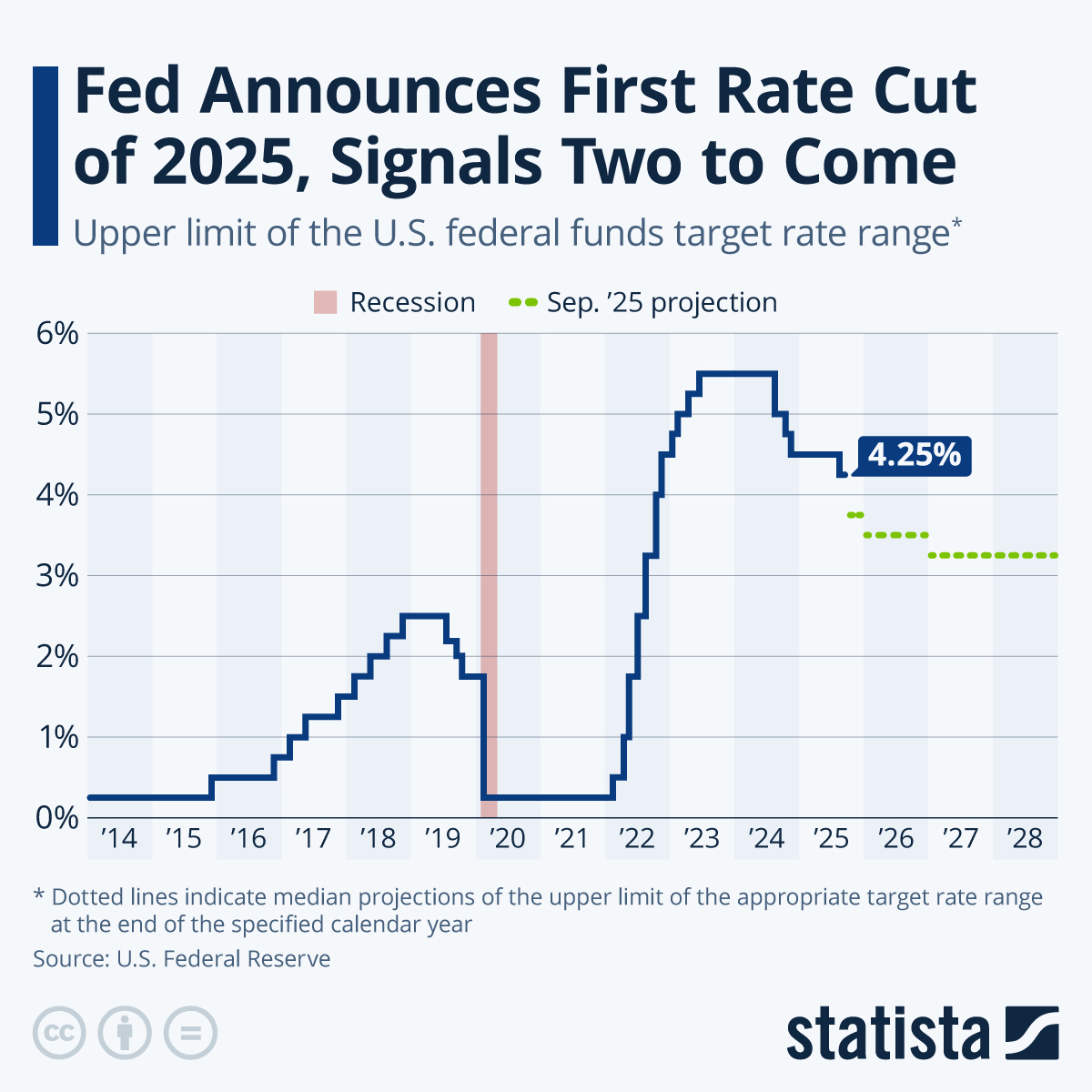

- High Mortgage Rates: With 30-year fixed mortgage rates hovering between 6.5% and 7%, affordability is strained, pushing some buyers to negotiate or delay purchases. This has increased rental demand, with San Diego’s rental market remaining competitive.

- Investor Activity: Cash buyers and investors, particularly those targeting fixer-uppers or properties with accessory dwelling unit (ADU) potential, continue to drive demand in certain submarkets.

San Diego Forecast for 2025–2026

Forecasts for San Diego suggest moderate growth rather than a sharp decline:

- Zillow predicts a 2.5% to 3.6% increase in home values by November 2025, with a slight dip (0.7%) possible from April 2025 to April 2026.

- Realtor.com projects a more optimistic 9% price increase in 2025, driven by ongoing demand.

- Some analysts, like those at firsttuesday Journal, warn of a potential price drop through 2027 due to trade uncertainties and declining sales volume, but they expect a recovery by 2028.

Overall, San Diego’s market is expected to remain resilient due to its strong fundamentals, though short-term price adjustments are possible as buyers gain more negotiating power.

National Housing Market: Stable but Affordability-Challenged

Nationally, the U.S. housing market in 2025 is characterized by high prices, improving inventory, and persistent affordability challenges. Key metrics include:

- Median Home Prices: The median existing-home price was $403,700 in March 2025, up 2.7% year-over-year, with January 2025 hitting a record high of $396,900 for the month.

- Inventory Levels: Inventory is growing, with 1.18 million unsold existing homes in January 2025, up 16.8% from the previous year. This equates to a 3.5- to 4-month supply, still below the 5- to 6-month range of a balanced market.

- Days on Market: Homes are taking longer to sell, with a median of 41 days in January 2025, compared to 36 days a year earlier.

- Sales Activity: Existing-home sales fell 5.9% in March 2025, reflecting affordability constraints, but the National Association of Realtors (NAR) predicts a 7% to 12% increase in sales for 2025.

Factors Shaping the National Market

The national market is influenced by broader economic trends:

- High Mortgage Rates: Rates for a 30-year fixed mortgage averaged 6.86% in April 2025, with forecasts suggesting they’ll stabilize around 6.5% to 7% through 2025. This discourages some buyers and keeps sellers with low-rate mortgages locked in.

- Affordability Crisis: High home prices and rates have made homeownership challenging, particularly for first-time buyers. However, stricter lending standards since the Great Recession reduce the risk of widespread defaults.

- Inventory Growth: New construction and a modest increase in existing-home listings are easing supply constraints, but the market remains undersupplied compared to pre-COVID levels.

- Economic Policies: Potential policies under a second Trump administration, such as tariffs and immigration changes, could increase construction costs and inflation, potentially pushing mortgage rates higher.

National Forecast for 2025–2029

Expert predictions for the national market vary but generally point to stability:

- The Mortgage Bankers Association forecasts home price growth slowing to 1.3% in 2025 and 0.3% in 2026.

- NAR predicts a 3% price increase in 2025 and 4% in 2026, with sales rising as inventory improves.

- Redfin estimates a 4% rise in median asking prices in 2025, with flat rent growth due to new rental inventory.

- Long-term projections (2025–2029) suggest annual appreciation of 3% to 5%, with no major crash expected unless significant economic shocks occur.

Is a Housing Market Crash on the Horizon?

San Diego: Low Crash Risk

A housing crash in San Diego is unlikely in 2025 for several reasons:

- Strong Fundamentals: The city’s robust job market, limited supply, and desirability as a place to live support stable prices. Unlike the 2008 crash, which was driven by loose lending, current lending standards are stricter.

- High Equity: Record home equity levels allow homeowners to sell quickly (within days to two weeks) if needed, reducing foreclosure risk.

- Moderate Corrections: While some forecasts predict a slight price dip (0.7% to 1%), this is far from a crash, which typically involves rapid, double-digit declines. San Diego’s projected dip is milder than in markets like San Francisco.

- Investor Demand: Cash buyers and investors continue to stabilize the market, particularly in high-demand neighborhoods.

However, risks such as trade wars, rising mortgage rates, or a broader economic downturn could slow growth or lead to longer-term price declines by 2027–2028.

National Market: Crash Unlikely but Risks Remain

Nationally, a crash is also not on the horizon, supported by:

- Stable Demand: Despite affordability challenges, pent-up demand from buyers and sellers is expected to drive 4 million home sales in 2025, up 2% to 9% from 2024.

- Equity and Lending Standards: High homeowner equity and strict lending practices mitigate foreclosure risks, unlike the subprime crisis of 2008.

- Inventory Growth: Increasing supply from new construction and existing homes is normalizing the market, reducing the likelihood of a bubble.

Potential risks include:

- Policy Impacts: Tariffs or immigration policies could raise construction costs and inflation, pushing mortgage rates higher and dampening demand.

- Foreclosure Uptick: Foreclosure starts rose 14% in Q1 2025, though levels remain below historical averages. Economic stress could exacerbate this trend.

- Regional Variations: Markets like Austin, Phoenix, or Florida face higher risks of price declines due to overbuilding or cooling demand, but these are not indicative of a national crash.

Conclusion: No Crash, but Caution Advised

Both the San Diego and national housing markets are poised for moderate growth in 2025, with no immediate signs of a crash. San Diego’s resilience stems from its strong economy, limited supply, and high demand, while the national market benefits from improving inventory and stable lending practices. However, affordability challenges, high mortgage rates, and potential policy shifts warrant caution.

Advice for Buyers and Sellers

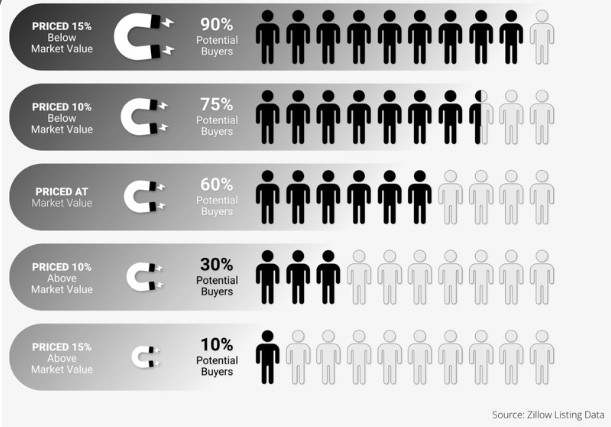

- Buyers: In San Diego, focus on well-priced properties in desirable neighborhoods, as competition remains high. Nationally, take advantage of growing inventory to negotiate better deals, but don’t wait for significant price drops. Work with a local real estate agent to navigate hyper-local conditions.

- Sellers: In San Diego, price competitively and highlight your home’s best features to stand out in a cooling market. Nationally, prepare for longer selling times and ensure your home is move-in ready to attract buyers.

- Investors: San Diego’s ADU potential and rental demand make it a strong long-term investment. Nationally, focus on markets with stable job growth and avoid overbuilt areas like Austin or Phoenix.

The housing market is complex, but by staying informed and acting strategically, you can navigate 2025’s challenges and opportunities with confidence. For the latest updates, keep reading these articles

If you are looking to sell a home, check out how we differentiate in the market by Looking into our Maximum Bid Home Sale System, which transcends most Real Estate Markets. https://14dayhomesale.homes/

Categories

Recent Posts