Recent Interest Rate Shifts: Navigating the Fed's Moves and Their Ripple Effects on Mortgage Rates

Recent Interest Rate Shifts: Navigating the Fed's Moves and Their Ripple Effects on Mortgage Rates

By Darel Ison Realtor & Real Estate Investor

The Federal Reserve’s recent interest rate decisions are impacting the housing market. As of October 7, 2025, the Fed’s first rate cut of the year drove mortgage rates to a three-year low of 6.26% in early September, though they’ve since risen to 6.34% for a 30-year fixed. Below, I’ll explain the Fed’s actions, their effect on mortgage rates, and practical steps for homebuyers and investors, based on the latest Fed announcements and market data.

The Fed’s 2025 Rate Landscape: From Pause to Cautious Cuts

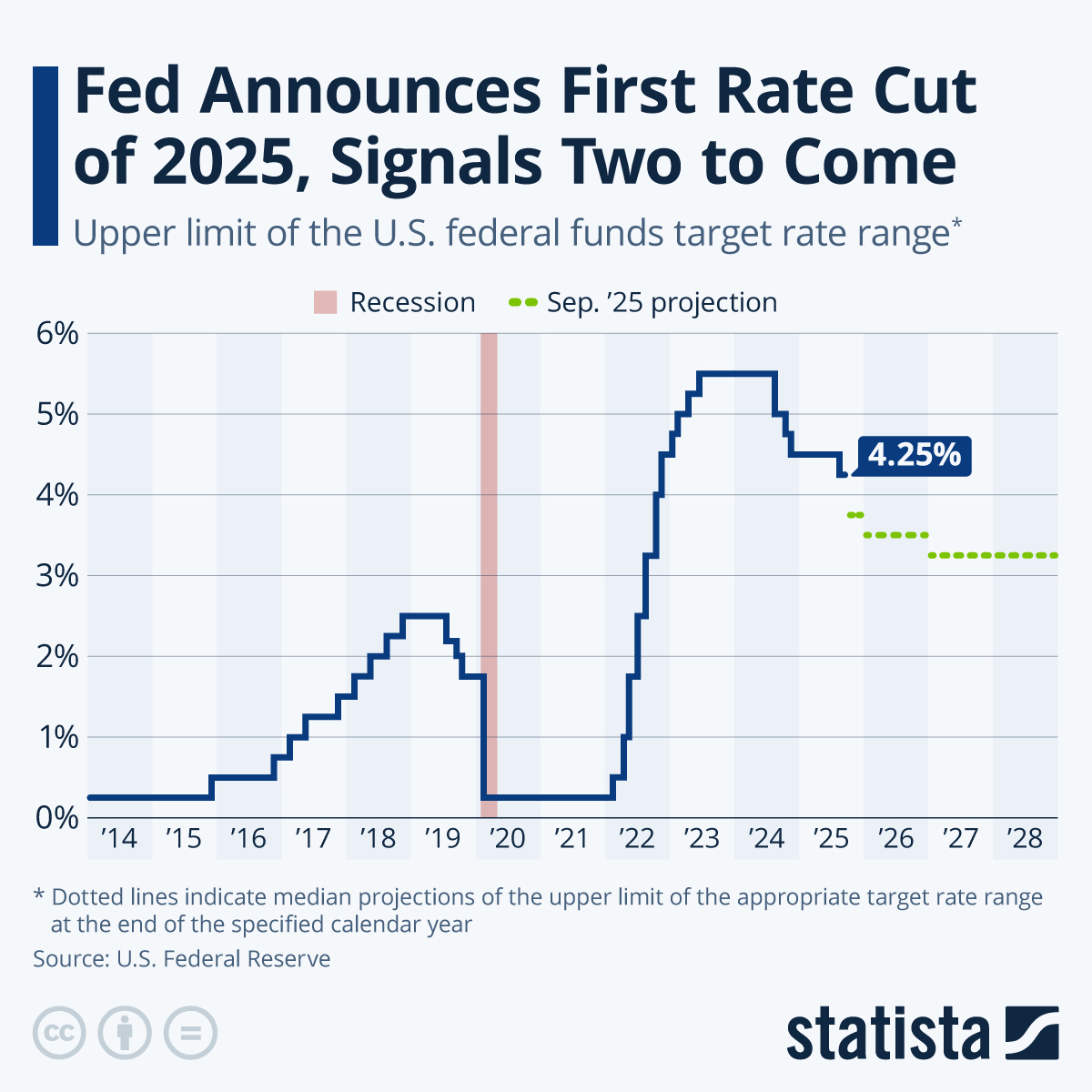

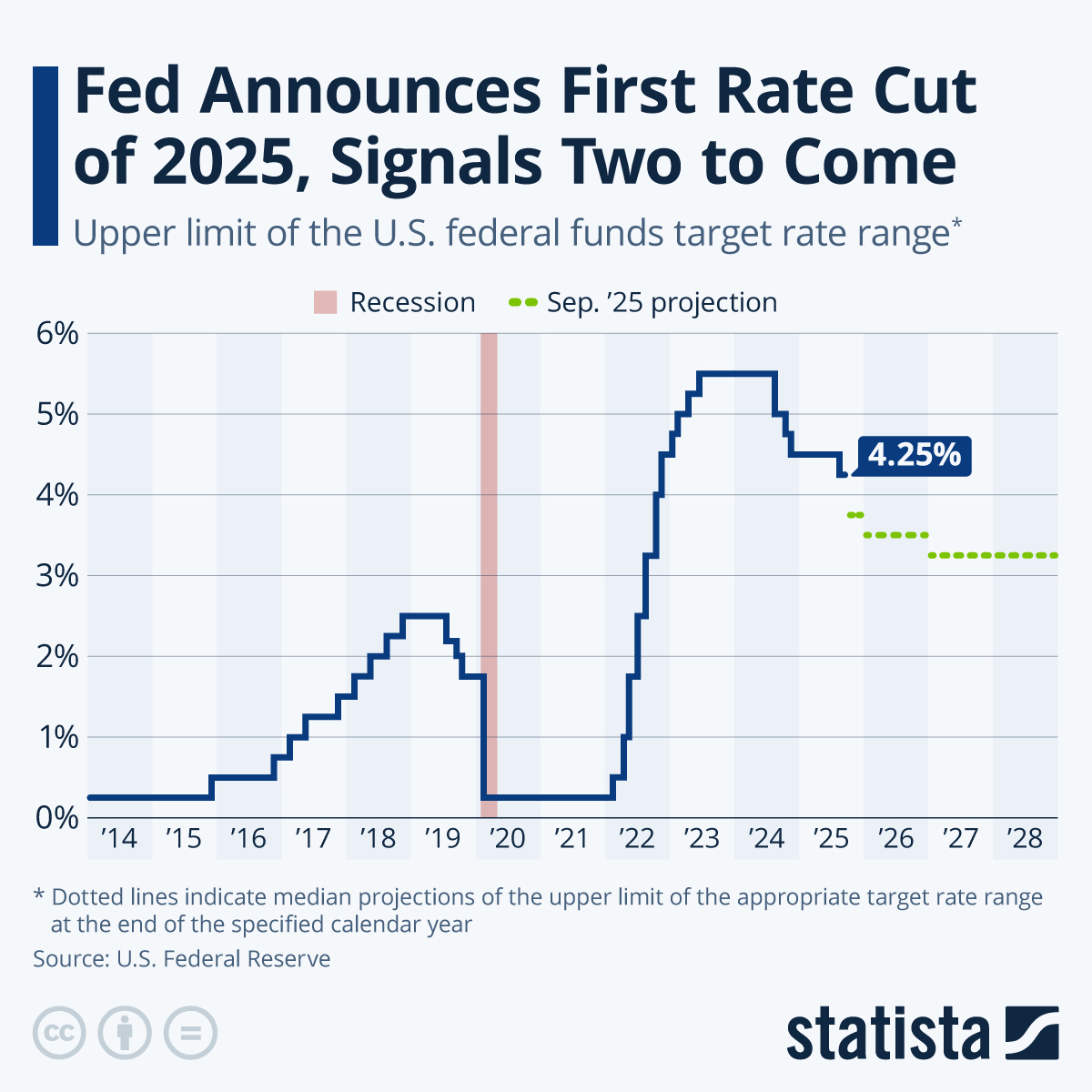

The Federal Reserve’s benchmark federal funds rate—the rate banks charge for overnight loans—sets the economic tone. After aggressive hikes in 2022 and 2023 to curb inflation, the Fed cut rates by a full percentage point in late 2024, bringing the range to 4.25%-4.50% across three quarter-point reductions. In 2025, inflation and a cooling job market prompted caution, with rates held steady through the first five meetings.

On September 17, 2025, the Fed cut rates by a quarter point to 4.00%-4.25%, responding to a softening labor market while aiming to avoid reigniting inflation. The Fed’s “dot plot” suggests one or two more cuts by year-end, possibly in October or December, but Chair Jerome Powell emphasized a cautious approach due to risks like potential tariffs.

Here’s a timeline of recent Fed actions:

|

Date |

Action |

Federal Funds Rate Range |

|---|---|---|

|

Late 2024 (Sept-Dec) |

Three 0.25% cuts |

4.25%-4.50% |

|

Jan-Jun 2025 |

Held steady (5 meetings) |

4.25%-4.50% |

|

Sept 17, 2025 |

0.25% cut |

4.00%-4.25% |

|

Oct 2025 (expected) |

Possible 0.25% cut |

TBD |

These are measured steps to balance employment and price stability.

How Fed Cuts Translate to Mortgage Rates: Not a Direct Path

Mortgage rates don’t move in lockstep with the federal funds rate—they’re influenced through the bond market. Fixed-rate mortgages, like the 30-year option, track 10-year Treasury note yields, which reflect investor expectations for inflation, growth, and Fed policy. Fed rate cuts signal easier money, often lowering yields and mortgage rates, but market sentiment can push back.

Before the September cut, mortgage rates fell from 6.89% in late May to 6.26% by early September, the lowest since late 2022. Applications surged 15-20% as buyers acted. Post-cut, rates rose to 6.34% by October 2, as investors reacted to the Fed’s cautious outlook and inflation concerns. Markets anticipate fewer cuts, so yields have ticked up.

Adjustable-rate mortgages (ARMs) are tied to short-term indices like SOFR, making their initial rates more responsive to Fed cuts. The National Association of Realtors (NAR) predicts 30-year rates averaging 6.7% through 2025, possibly dipping to 6% in 2026 with further cuts.

Here’s the impact on a $400,000 loan (20% down):

|

Rate |

Monthly Principal & Interest |

Total Interest Over 30 Years |

Savings vs. 7% Rate |

|---|---|---|---|

|

6.26% (Sept Low) |

$2,410 |

$468,600 |

$84,000 |

|

6.34% (Current) |

$2,430 |

$475,000 |

$77,600 |

|

6.89% (May High) |

$2,510 |

$503,600 |

Baseline |

A half-point drop saves tens of thousands over a loan’s life.

The Bigger Picture: Opportunities and Challenges

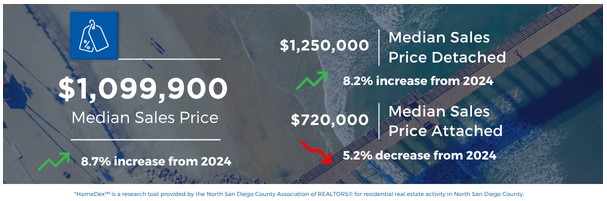

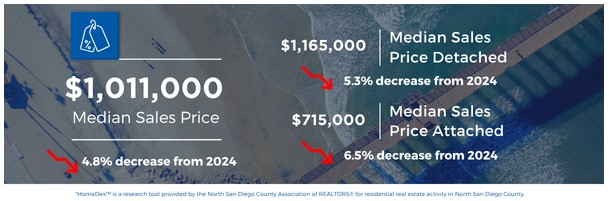

Lower rates boosted pending home sales by 5% in September, thawing the market. But affordability remains tight: Median home prices hit $416,900 in Q1 2025, and rates above 6% keep monthly costs 20-30% higher than pandemic lows. For investors, this creates opportunities—distressed properties or multifamily units for rental income.

Refinancers: If your rate is 7% or higher, refinancing at 6.3% could save $100+ monthly. First-time buyers: Explore FHA or VA loans for easier entry. Investors: Lock in fixed rates on leveraged deals to hedge against future hikes.

The October Fed meeting and inflation data are key. More cuts could push rates below 6.2%; a pause might lift them to 6.5-6.8% into 2026. Rates under 7% are favorable compared to 2023 highs.

Actionable Advice

Get pre-approved now—compare three lenders to secure the best rate. Investors, stress-test deals at 6.5-7% to prepare for volatility. Consider buying points (prepaid interest) to lower your rate by 0.25% for long-term holds. Monitor Freddie Mac’s weekly survey or the CME FedWatch tool for updates. If you’re planning a purchase, refinance, or investment, reach out for guidance.

Darel Ison is a real estate investor and Realtor. Connect at https://abundantpathhomes.com.

Categories

Recent Posts