San Diego Housing Market: Cooling Off After the Heat – Last 3 Months Breakdown with a Spotlight on June&July 2025

San Diego Housing Market: Cooling Off After the Heat – Last 3 Months Breakdown with a Spotlight on June & July 2025

Darel Ison here – the no-BS real estate guy who's been in the trenches helping clients cut through the hype. If you've followed my stuff at Abundant Path Homes, you know I don't sugarcoat it. The San Diego housing market? It's shifting, and not in the "everything's booming forever" way some folks want you to believe. Over the last three months – from mid-April to mid-July 2025 – we've seen a clear cooldown. Sales are dipping, inventory is piling up, and prices are starting to feel the pressure. But let's zoom in on the last 30 days (mid-June to mid-July), where the trends are really accelerating. I'll break it down with real data, no fluff, and what it means for you, whether you're buying, selling, or just watching from the sidelines.

The Big Picture: From Frenzy to Balance in Just 90 Days

Back in April 2025, San Diego was still riding high on post-pandemic vibes. Median home prices were pushing $990,000, up massively from five years ago when they hovered around $630,000. Inventory was starting to creep up – a whopping 70% year-over-year jump in the metro area, the sharpest among the top 50 U.S. markets. That was the first red flag: more homes hitting the market meant buyers weren't scrambling like they used to.

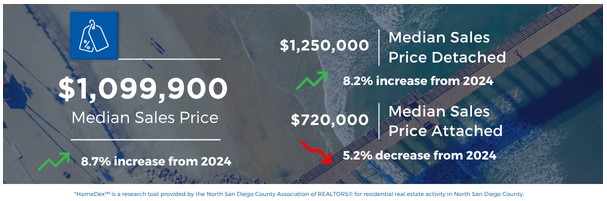

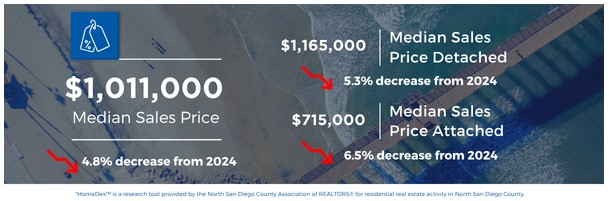

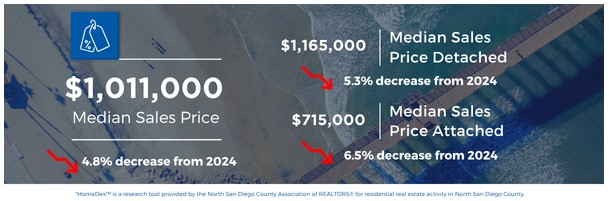

Fast-forward to May, and the cracks widened. Sales cooled off while prices inched up month-over-month. Median sold prices hit around $994,000, a modest 1.4% year-over-year gain, but homes were taking about 20 days to sell – longer than the peak frenzy days. By June, things tilted further: closed sales ticked down slightly, new listings climbed, and the median sold price settled at $876,062 (up 2.2% year-over-year, but per square foot at $675). Listing prices? They dropped to $949,000, down 4.9% from last year.

Overall average home values as of July? Sitting at $1,023,300, but that's down 2.5% over the past year. The market's rebalancing – not crashing, but definitely not the seller's paradise it was. Inventory for detached homes is up 50% year-over-year, and attached (condos/townhomes) is up 59%. Days on market are stretching out, especially in North County where prices are cooling midway through the year.

Zooming In: The Last 30 Days – Where the Shift Accelerates

If the last three months were a cooling engine, the period from mid-June to mid-July 2025 is when it hit the gas. June's data rolled into early July shows the market tilting more toward buyers. Closed sales continued their slide from May, with fewer deals closing amid rising supply. New listings kept pouring in, building on April's surge and May's steady climb. This isn't a blip – it's a pattern.

Prices? They're softening. While year-over-year gains hold (barely) at 1.3-2.2% in some metrics, month-to-month tells a different story. In North County, home prices are outright cooling, with days on market signaling buyers are taking their sweet time. Rents are up 4.1% countywide (9.3% in the city), which is squeezing affordability even more and keeping some folks from jumping into ownership. Inventory? Still exploding – that 50-70% year-over-year growth hasn't let up, giving buyers more choices and less urgency.

Recent chatter from local agents on X echoes this: "The market's no longer on fire, but far from collapsing – it's rebalancing." One update notes sales dropping while prices rise slightly in May, but by June/July, the emphasis is on the inventory surge and longer listing times. Even in hotspots like Pacific Beach, stats show a similar slowdown.

What Does This Mean for Buyers and Sellers?

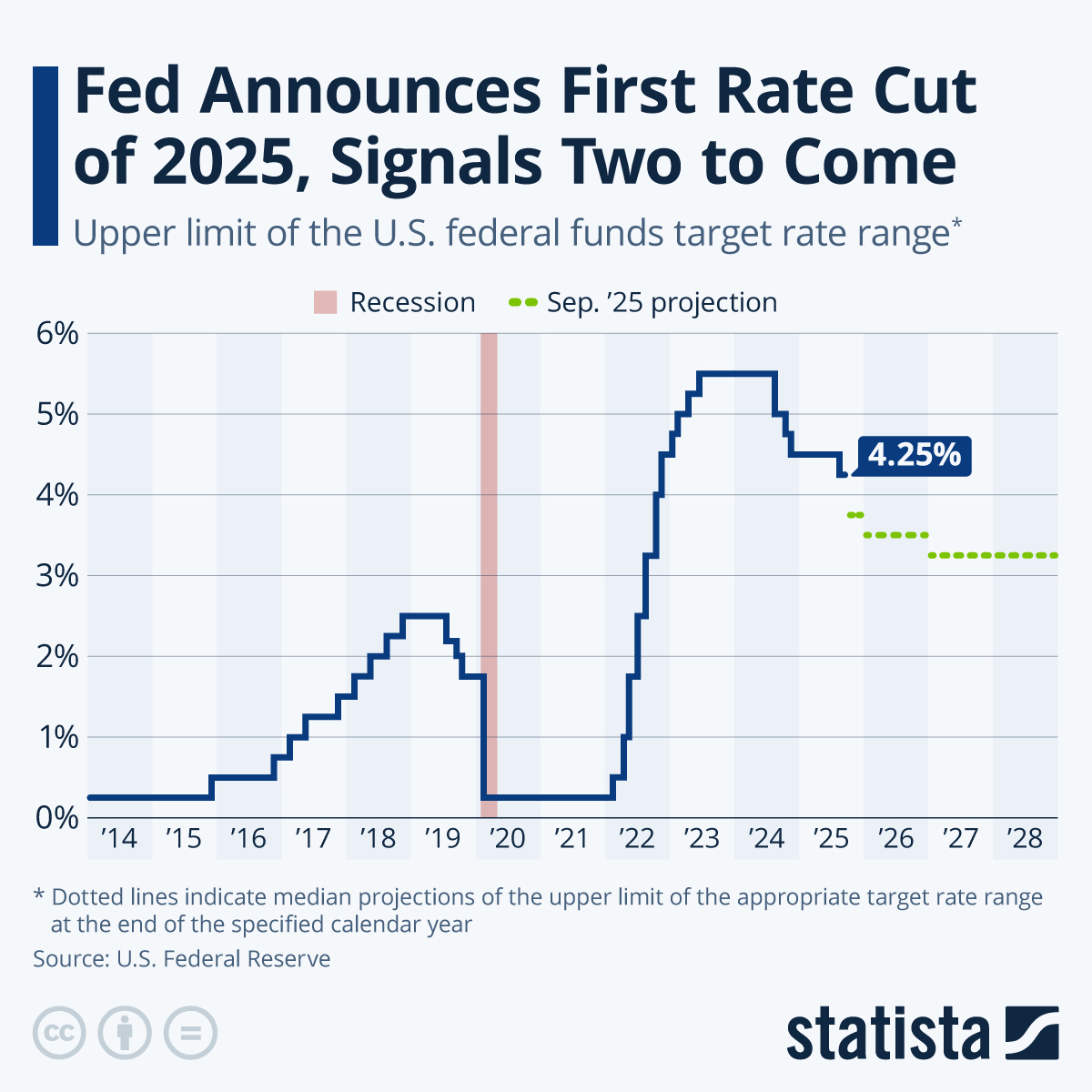

For buyers: This is your window. More inventory means more negotiating power – fewer bidding wars, and potentially better deals as sellers adjust to longer days on market. But don't sleep on it; prices aren't plummeting (forecasts say they're unlikely to drop in 2025 overall, possibly even rising slightly over 2024). Affordability's still strained with high rates, so get pre-approved and focus on walkable, tech-friendly spots that millennials crave.

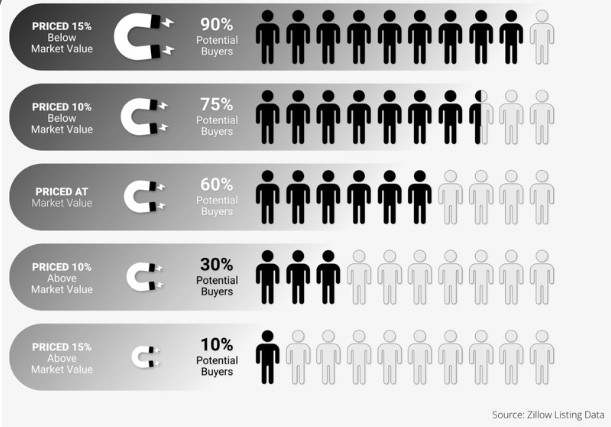

For sellers: Time to get real. Price aggressively from day one – no testing the waters with inflated asks. The market's shifted; buyers have options, and if your home lingers, you'll chase the price down. Highlight what sets you apart, like energy efficiency or location perks. Consider partnering with an agent who specializes in pricing low and using a transparent bidding system, like we do at Abundant Path Homes. This approach benefits sellers by attracting a larger pool of interested buyers right out of the gate, fostering genuine competition through open and clear bidding processes that build trust and urgency. The result? You can still generate multiple offers, often driving the final sale price higher than a traditional high-list strategy, while minimizing days on market and reducing the risk of stale listings in this cooling environment.

Overall insight: San Diego's not immune to national trends. We're seeing a balanced market emerge, with regional quirks – like El Cajon lagging in new builds per capita, which keeps some pressure on supply long-term. If rates ease or inventory keeps surging, we could see broader corrections. But for now, it's a buyer's gain, seller's adapt-or-lose scenario.

Want the full scoop tailored to your situation? Hit me up at Abundant Path Homes – let's chat zero-BS strategy. Whether you're looking to buy, sell, or invest in San Diego real estate, I've got the tools.

Stay sharp out there, San Diego.

– Darel Ison, Abundant Path Homes

Categories

Recent Posts