Options for Homeowners Facing Preforeclosure: Exploring Alternatives

As a real estate professional, I often meet homeowners who are navigating the stressful and overwhelming situation of preforeclosure. While I cannot provide legal or professional advice, I can share information about potential options that may help you avoid the public foreclosure process and its long-term impacts, including significant effects on your credit score. Time is critical in these situations, so acting quickly and consulting with qualified professionals, such as attorneys or financial advisors, is essential. Below, I’ll outline some common alternatives to foreclosure, their potential impacts on your credit score, and why exploring these options might be beneficial.

Understanding Preforeclosure

Preforeclosure occurs when a homeowner has missed mortgage payments, and the lender has issued a notice of default. This is a critical window where homeowners may have the opportunity to take action before the property proceeds to a public foreclosure auction. The foreclosure process can have significant emotional and financial consequences, including damage to your credit (potentially lowering your credit score by up to 160 points) and challenges in securing future housing. However, there are alternatives that may help you avoid these outcomes, depending on your situation and the lender’s policies.

Alternatives to Foreclosure

Here are some options that homeowners in preforeclosure may consider, along with their potential impact on your credit score. Please note that the information provided is for informational purposes only and may vary based on your lender, state laws, and individual circumstances. Always consult with a qualified professional to determine the best course of action.

1. Short Sale

A short sale occurs when a homeowner sells their property for less than the outstanding mortgage balance, with the lender’s approval. This option can help you avoid the full impact of a foreclosure.

-

Credit Impact: A short sale may lower your credit score by approximately 50-125 points, depending on your situation. It may appear on your credit report as “settled” or “paid in full for less than the loan balance.”

-

Future Homeownership: You may qualify for an FHA or Fannie Mae-backed loan much sooner than after a foreclosure, potentially within 2-3 years.

-

Financial Outcome: If approved, the lender may release you from further monetary obligations, meaning you won’t be pursued for the remaining loan balance (known as a deficiency). However, not all lenders agree to this, so it’s important to clarify terms.

-

Considerations: A short sale requires lender approval, which can take time. Working with a real estate professional to manage the paperwork and negotiations can streamline the process.

2. Deed in Lieu of Foreclosure

A deed in lieu of foreclosure involves voluntarily transferring the property’s title to the lender to satisfy the mortgage debt. This can be a less damaging alternative to foreclosure.

-

Credit Impact: This option may reduce your credit score by approximately 50-125 points, typically less severe than a foreclosure’s potential 160-point drop.

-

Financial Outcome: If accepted, the lender may release you from further financial obligations, eliminating the risk of a deficiency judgment (where applicable).

-

Considerations: Lenders may not always accept a deed in lieu, and the process requires negotiation. Consulting with a professional can help determine if this is a viable option.

3. Quick Offer or Traditional Sale

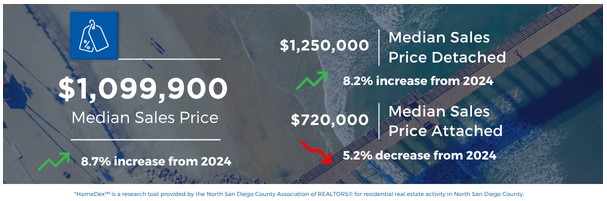

If you have equity in your home (meaning the property’s value exceeds the mortgage balance), selling the property through a quick offer or traditional sale may allow you to pay off the mortgage and avoid foreclosure entirely.

-

Credit Impact: Only missed payments will appear on your credit report, typically reducing your credit score by 50-100 points, depending on the number and timing of missed payments. No foreclosure or additional defaults will be recorded, making this less damaging than other options.

-

Financial Outcome: If there’s equity in the home, you may walk away with cash after the sale, providing financial relief and resources for your next steps.

-

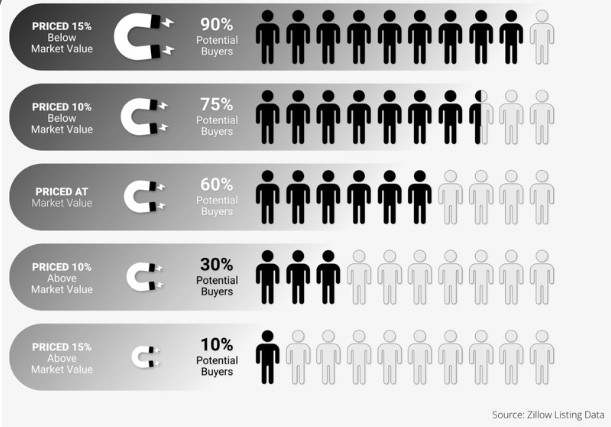

Considerations: This option works best if the property is in good condition and there’s enough time to market and sell it. A real estate professional can help you price the home competitively and manage the sale process efficiently.

4. Loan Modification or Forbearance

While not always guaranteed, some homeowners may negotiate with their lender for a loan modification (adjusting the terms of the mortgage) or forbearance (temporary pause or reduction in payments). These options depend on the lender’s policies and your financial situation.

-

Credit Impact: These arrangements may have minimal impact on your credit score, typically 10-50 points, if you resume regular payments. Late payments already reported may still affect your score.

-

Financial Outcome: They can help you stay in your home by making payments more manageable.

-

Considerations: Approval is not guaranteed, and you’ll need to work directly with your lender. A housing counselor or attorney may assist in these discussions.

Why Act Quickly?

Preforeclosure is a time-sensitive period. Once the process moves to a public foreclosure auction, your options become limited, and the consequences—such as significant credit damage (up to 160 points) and potential deficiency judgments—become harder to avoid. Recent market changes, lender policy shifts, and federal mandates have made alternatives like short sales and deeds in lieu more accessible than in the past. By exploring these options early, you may find a solution that minimizes financial and emotional stress.

Working with a Real Estate Professional

As a real estate consultant, my role is to provide information, guide you through the process, and handle the paperwork and negotiations with lenders or buyers. There are typically no upfront costs for my services, as compensation is usually paid at closing from the sale proceeds (if applicable). While I cannot guarantee specific outcomes, I can offer insights and help you explore your options. If your situation requires legal or financial expertise, I’ll recommend consulting with an attorney or other qualified professional.

Next Steps

If you’re facing preforeclosure, don’t wait to take action. Here’s what you can do:

-

Contact a Real Estate Professional: Reach out to discuss your situation and explore potential solutions. There’s no cost for an initial consultation, and time is of the essence.

-

Consult with an Attorney: For legal questions or complex financial matters, an attorney can provide tailored advice.

-

Speak with Your Lender: Ask about loan modification, forbearance, or other relief options they may offer.

-

Consider a Housing Counselor: Nonprofit organizations, such as those approved by the U.S. Department of Housing and Urban Development (HUD), can provide free or low-cost guidance.

Facing preforeclosure is undoubtedly challenging, but you don’t have to go through it alone. By exploring your options and acting quickly, you may find a path that helps you move forward with greater peace of mind. For more information or to discuss your situation, feel free to contact me at (858) 229-1625 or Darel@abundantpathhomes.com.

Disclaimer: This article is for informational purposes only and does not constitute legal, financial, or professional advice. Always consult with qualified professionals, such as attorneys or financial advisors, for advice specific to your situation. The information provided, including the comparison of foreclosure alternatives and credit score impacts, is subject to inaccuracies and may vary based on individual circumstances, lender policies, and state laws.

Want to find out your homes estimated value? Click Here

Categories

Recent Posts