Why Now is the Perfect Time for First-Time Home Buyers in San Diego

Are you a first-time home buyer in San Diego dreaming of owning a home? The market has shifted in your favor as of April 2025. With interest rates stabilizing and fewer buyers competing, there’s less competition now than there will be when rates drop. At Abundant Path Homes, we’re here to help you secure affordable homes in San Diego before the rush returns. This guide covers why acting now is smart, explores San Diego home loans (including options for repairs and ADUs), highlights budget-friendly areas, and explains how tax advantages let you afford more than renting—making buying a home in San Diego a reality today.

Less Competition for First-Time Home Buyers in San Diego—Act Now

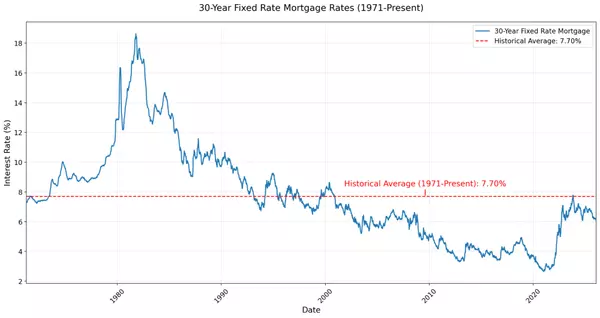

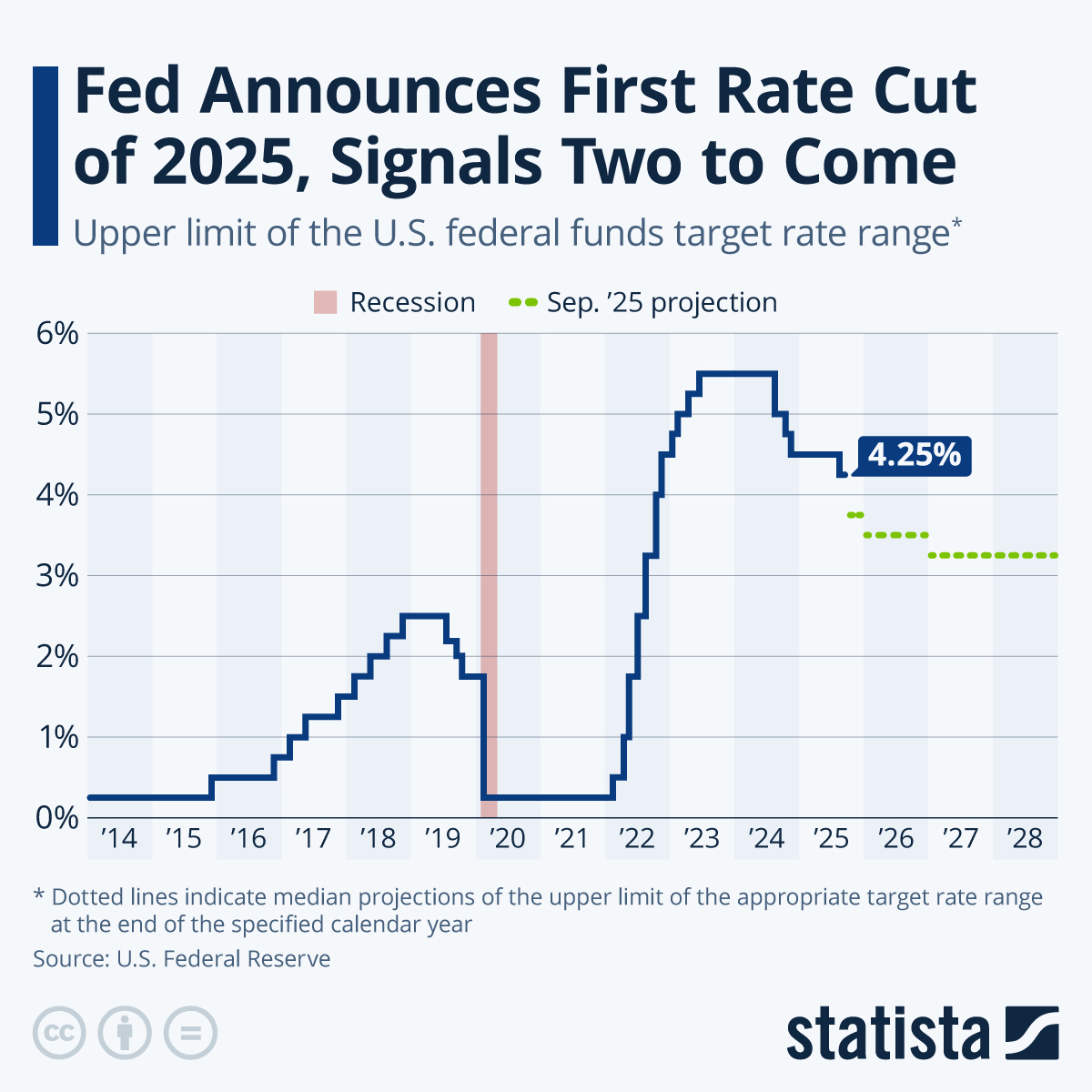

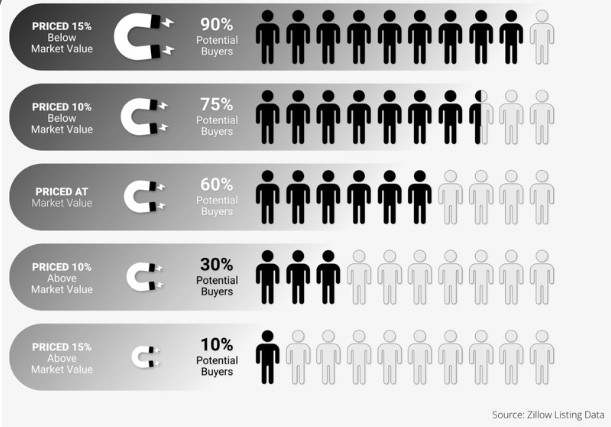

San Diego’s housing market has cooled from its peak. Higher rates in 2024 reduced buyer activity, meaning homes for sale in San Diego stay on the market longer and sellers are more negotiable. But this won’t last. When interest rates drop—possibly later in 2025—competition will surge, driving up prices for San Diego real estate. Partner with Abundant Path Homes to lock in an affordable home in San Diego now, avoiding the stress and cost of a heated market.

San Diego Home Loans for First-Time Buyers

High prices don’t mean homeownership is out of reach. San Diego home loans tailored for first-time home buyers can make it happen—some even fund repairs or ADUs. Here’s what’s available:

- FHA Loans: Just 3.5% down, lenient credit (580+), and the FHA 203(k) option for repairs or remodels—ideal for buying a fixer-upper in San Diego.

- VA Loans: 0% down for veterans, no PMI, and VA Renovation Loans for upgrades.

- CalHFA Loans: Low-interest rates, down payment help (MyHome, up to 3.5%), and an ADU Grant Program (up to $40,000) for extra income or space.

- San Diego Housing Commission (SDHC) Programs: Deferred loans up to 22% of the price at 3% interest, plus $10,000 closing cost grants for low- to moderate-income buyers.

- USDA Loans: 0% down for rural San Diego County areas, with USDA Repair Loans for renovations.

- Fannie Mae HomeStyle Loan: Up to 97% loan-to-value, covering repairs or ADUs—perfect for customizing affordable homes in San Diego.

ADUs are a game-changer for San Diego real estate, adding rental income or living space. Abundant Path Homes connects you with lenders to find the best San Diego home loan for your goals—move-in-ready or a project home.

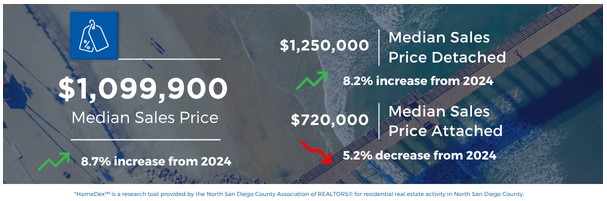

Affordable Areas for Homes in San Diego

The median price for San Diego homes is around $950,000, but first-time home buyers in San Diego can find affordable homes in these areas:

- El Cajon: $500,000-$700,000 for homes and condos in East County—convenient and budget-friendly.

- Chula Vista: $600,000-$800,000 south of downtown, with family-friendly options.

- Spring Valley: Starting at $550,000—great for buying a home in San Diego with potential.

- National City: $450,000-$650,000—a top pick for affordable San Diego real estate.

- Oceanside: $600,000-$800,000 for North County coastal value.

- Vista: $550,000-$700,000—suburban charm at a lower cost.

- San Marcos: $600,000-$750,000—growing and accessible.

These neighborhoods offer equity potential without breaking the bank. Abundant Path Homes specializes in finding affordable homes in San Diego—some perfect for ADUs or remodels.

Afford More Than Rent with Tax Advantages of Homeownership

Renting in San Diego costs $2,500-$3,000/month with no return, but buying a home in San Diego offers tax perks that boost your budget. Homeowners deduct mortgage interest and property taxes (up to $750,000 debt and $10,000 taxes). For a $600,000 home at 6% interest, you might save $8,000+ on interest and $1,300 on taxes yearly in the 22% bracket—nearly $10,000 back. That drops a $3,000 mortgage to feel like $2,200 after taxes, often less than rent. Abundant Path Homes can show you how these savings make San Diego real estate more affordable than you think.

Buy What You Can Afford Now vs. Waiting

Your dream San Diego home—a coastal condo or Point Loma craftsman—might be out of reach today. No problem. Buying a home in San Diego now builds equity and leverages tax advantages, setting you up for upgrades later. A $600,000 home in Oceanside with a 3.5% FHA down payment ($21,000), plus an ADU or repairs via a 203(k) loan, grows with you. Waiting for lower rates risks higher prices— that home could hit $650,000 when competition returns. Abundant Path Homes helps you act strategically now.

Start Your Journey with Abundant Path Homes

Now’s the time for first-time home buyers in San Diego. With less competition, San Diego home loans for repairs and ADUs, tax advantages over renting, and affordable homes in San Diego like Oceanside, Vista, and San Marcos, 2025 is your moment. Don’t wait for the crowd.

Contact Abundant Path Homes for a free consultation. We’ll match you with lenders, find homes for sale in San Diego you can afford, and guide you every step. Call [858.229.1625] or email [darel@abundantpathhomes.com] to secure your San Diego real estate future today!

Categories

Recent Posts