Downsizing in San Diego: A Guide for Empty Nesters

Downsizing in San Diego: A Guide for Empty Nesters

After the kids have flown the coop, the family home can start to feel a little too big, a little too quiet, and—let’s be honest—a little too much to maintain. If you’re an empty nester in San Diego, you might be wondering if it’s the right time to downsize. Let’s explore what the current market looks like, how interest rates come into play, and what your options are based on your home equity. Plus, for those 55 and older, there’s a special tax perk you won’t want to miss!

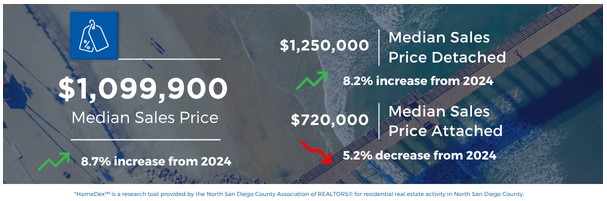

San Diego’s Market Snapshot

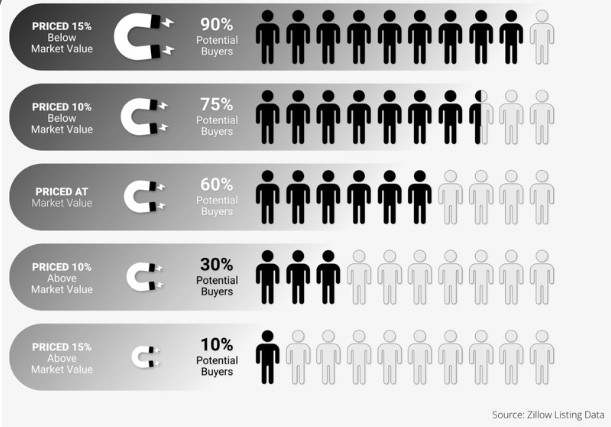

San Diego remains a highly desirable place to live, with beautiful weather, vibrant neighborhoods, and no shortage of things to do. The real estate market here continues to show resilience. Inventory is still relatively tight, which means homes—especially well-maintained ones in established neighborhoods—tend to sell quickly and for strong prices. This is great news if you’re selling a larger home, as you may be able to tap into significant equity built up over the years.

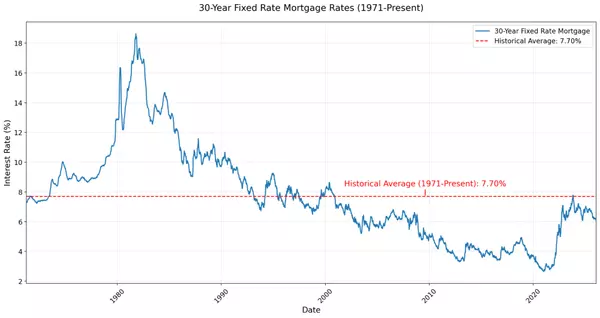

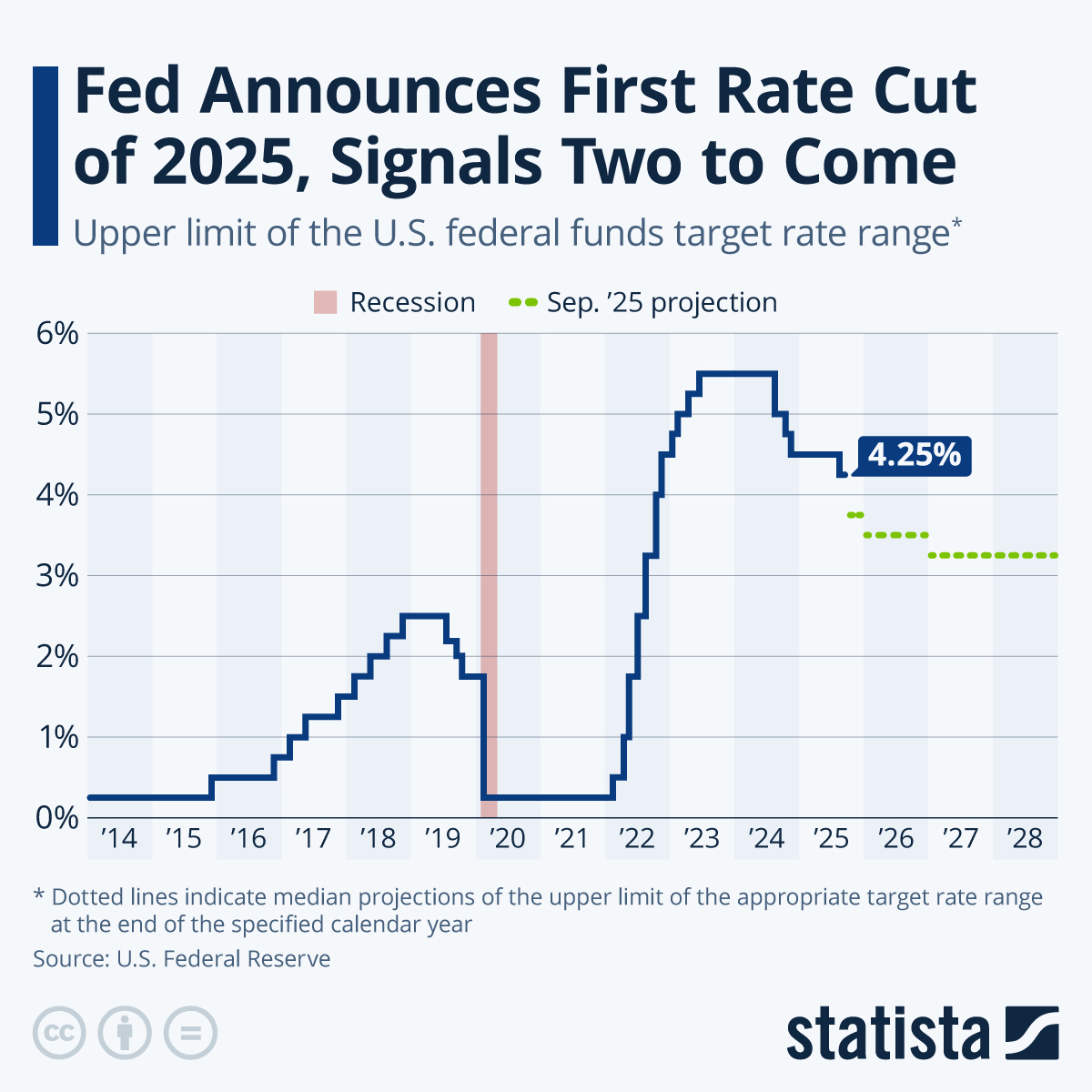

Navigating Interest Rate Concerns

Interest rates have been a hot topic lately. While rates are higher than they were a few years ago, they are still historically moderate. If you’re downsizing, the impact of higher rates can be offset by the equity you’ve gained in your current home, potentially allowing you to purchase a smaller home with a more manageable mortgage—or even buy outright. If you don’t have as much equity, it’s important to work with a lender to understand your options. There are creative financing solutions out there, and a good real estate agent can connect you with trusted professionals.

Equity: Your Secret Weapon (or Not)

- If you have a lot of equity: Congratulations! You may be able to downsize and pocket a tidy sum, use it to travel, invest, or simply enjoy a lower cost of living. Many empty nesters find themselves able to buy their next home with cash or a very small mortgage.

- If your equity is limited: Don’t be discouraged. Downsizing can still make sense if it reduces your monthly expenses and maintenance headaches. You might also consider condos or townhomes, which often come with amenities and less upkeep.

The 55+ Tax Transfer Advantage

Here’s a little-known California benefit: If you’re 55 or older, you can transfer the property tax basis from your existing home to a new primary residence—up to three times in your lifetime! This means you could buy a new home (even if it’s more expensive) and keep your lower property tax bill, which can be a huge savings over time. This rule is a game-changer for many empty nesters looking to move without facing a big property tax jump.

Downsizing is a big decision, but it can open the door to new adventures, less stress, and more freedom to enjoy what matters most. If you’re curious about your options or want to know how much your home is worth in today’s market, let’s connect and explore your next chapter in beautiful San Diego! You can contact me @ 858.229.2625 or Darel@abundantpathhomes.com

Categories

Recent Posts