Mortgage Rate Trends: 2025 in Review and What’s Ahead for 2026 in San Diego

Mortgage Rate Trends: 2025 in Review and What’s Ahead for 2026 in San Diego

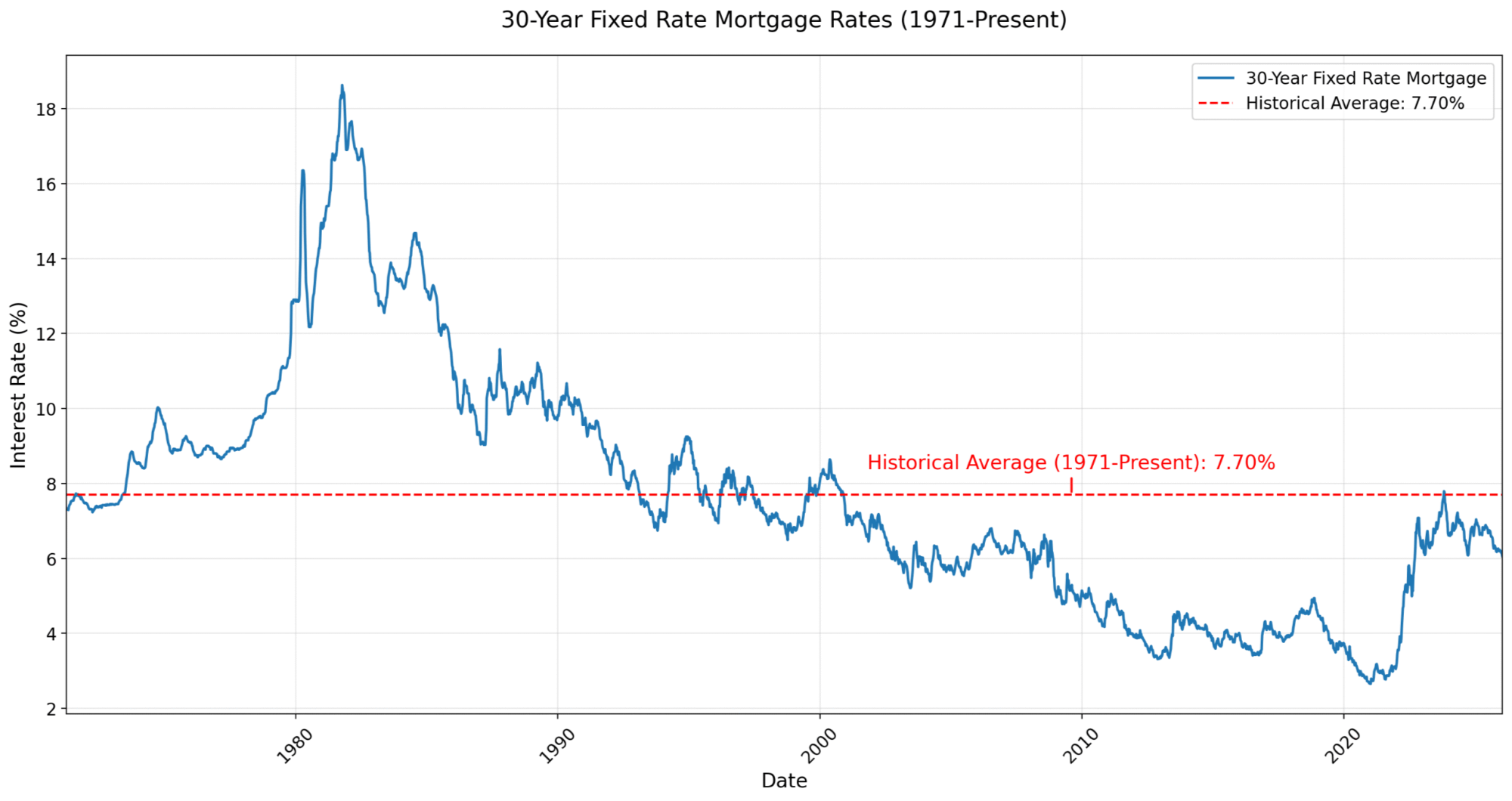

If you’ve been following the San Diego housing market, you know mortgage rates have been on a wild ride lately. Let’s take a quick stroll through what happened in 2025 and what might be coming in 2026. Plus, there’s a big change at the top of the Federal Reserve that could shake things up.

2025: A Year of Surprises

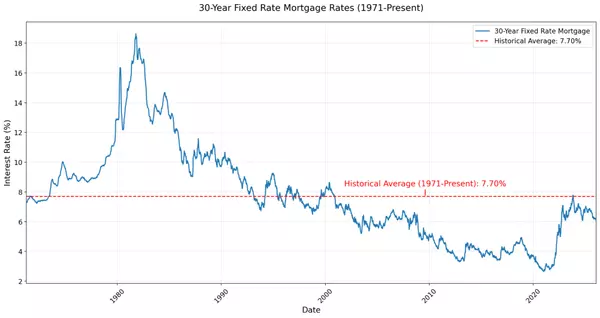

Last year started off with rates hovering around 6.5%, but by summer, we saw them dip closer to 6% as inflation cooled and the Fed eased up on rate hikes. San Diego buyers and homeowners felt a little relief, but the market stayed competitive. By late fall, rates bounced up again as economic uncertainty crept in, ending the year with a lot of folks wondering what’s next.

2026: What Could Be Next?

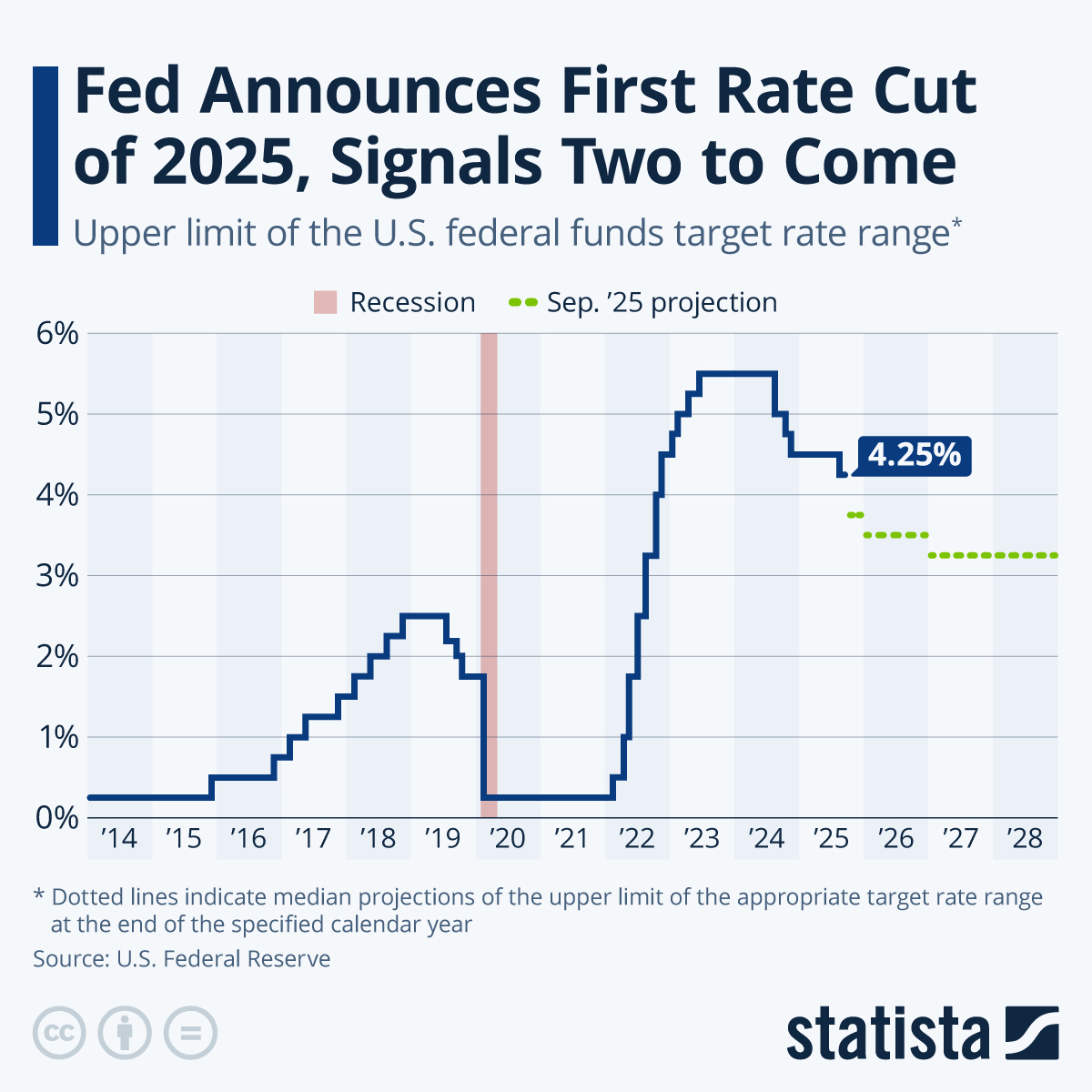

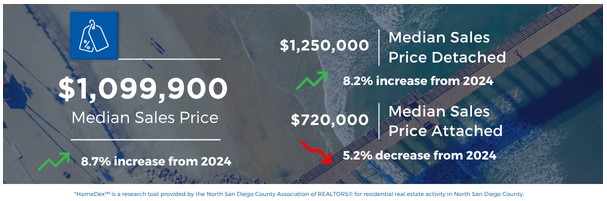

Most experts predict rates could drop further in 2026, especially with inflation stabilizing and new leadership at the Fed. In San Diego, where affordability is always a hot topic, even a small drop in rates could spark more activity. That means more buyers jumping in and maybe a little less pressure on monthly payments.

The Fed Chairman Change: What to Watch

Jerome Powell is set to step down in May and any time there’s a new Fed chair, markets pay close attention. While the Fed’s overall mission will not change, a new leader could bring a different style or focus. For San Diego, this means keeping an eye on how the new chair communicates about inflation and rate policy, because those words can move mortgage rates almost overnight.

Fast vs. Slow: How Should Rates Fall?

There’s a lot of debate about whether it’s better for rates to drop quickly or slowly. Here’s a quick breakdown:

- Rapid Drop: More buyers might rush into the market, boosting demand and possibly driving up home prices. Homeowners could refinance and save money fast. But too quick a drop can also fuel volatility and create bidding wars.

- Gradual Decline: A slow, steady drop gives buyers and sellers time to adjust. It can help keep the market balanced and reduce the risk of sudden price spikes. But it might mean waiting longer for real relief on monthly payments.

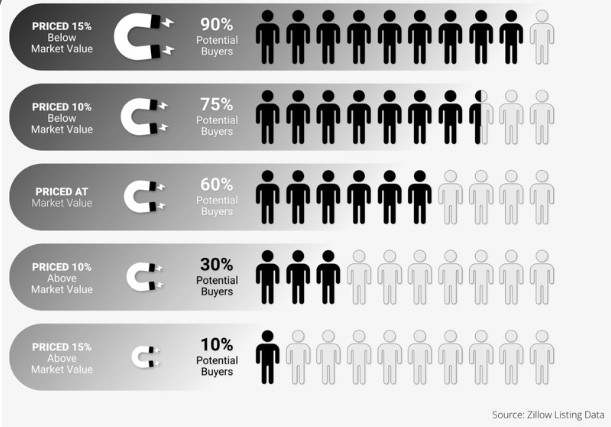

Should You Wait or Buy Now?

Here’s something to think about. Buying now, while rates are a bit higher, could mean less competition and a better price on your dream home. If you wait for rates to drop, there will likely be more buyers in the market, which could make it harder to win the home you really want. Today’s market is actually more of a buyer’s market, putting you in the driver seat. The good news? You can always refinance later if rates fall. Sometimes, acting sooner rather than later is the smart move, especially in a sought after market like San Diego.

Bottom line? Whether rates fall fast or slow, San Diego’s market is likely to stay lively. If you’re thinking about buying or refinancing, keep an eye on the news this spring. 2026 could bring some interesting twists!

For help in selling or buying your next Home or Investment, contact me at 858.229.1625 or Darel@abundantpathhomes.com

Categories

Recent Posts