“Your Guide to FSBO in San Diego? Navigate the Process or Choose Our Zero-Commission* Program”

How to Sell Your Home FSBO in San Diego: A Comprehensive Guide for Success

Selling your home For Sale By Owner (FSBO) in San Diego, CA, is a bold move that gives you control and the potential to save thousands in commissions. At Abundant Path Homes, we respect your ambition and aim to be your ally by providing a detailed guide to listing, marketing, selling, and closing your home. This roadmap outlines the steps and challenges of FSBO, equipping you with the knowledge to succeed. If it feels overwhelming, we’ll introduce our “Sell Your Home Yourself, While It’s Listed, and Pay Zero Commission”* program at the end—a seamless way to maximize your profits with minimal stress.

Step 1: Preparing Your Home for Sale

To stand out in San Diego’s competitive market, your home must captivate buyers from the outset.

• Staging: Declutter, depersonalize, and arrange furniture to showcase your home’s potential. Professional staging costs $1,500–$5,000, or you can DIY to highlight space and flow.

• Repairs and Upgrades: Fix minor issues like leaky faucets or chipped paint, and consider updates like fresh paint or modern fixtures. San Diego buyers expect move-in-ready homes.

• Curb Appeal: Mow the lawn, trim hedges, and add potted plants for a welcoming exterior.

• Professional Photography: High-quality photos are essential, as 90% of buyers search online. Hire a photographer for $300–$800 to capture your home’s best features.

• Virtual Tour: A 3D virtual tour or video walkthrough is critical for online visibility. Costs range from $300–$800, depending on home size and tour complexity.

Challenge: You’ll need to research which upgrades and visuals offer the best ROI. Skimping on professional photography or virtual tours can deter buyers, while overspending reduces profits.

Step 2: Pricing Your Home Correctly

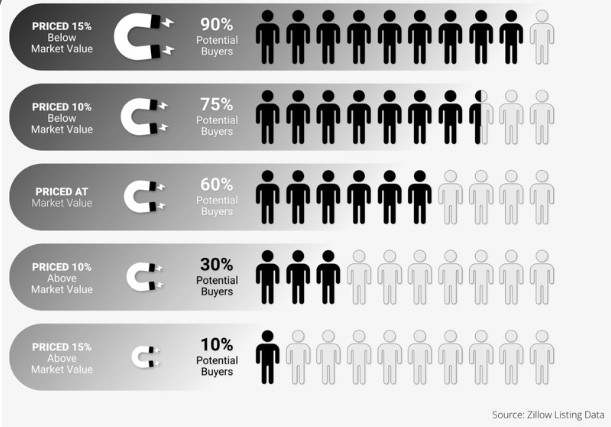

Pricing accurately is crucial to attract buyers without sacrificing value.

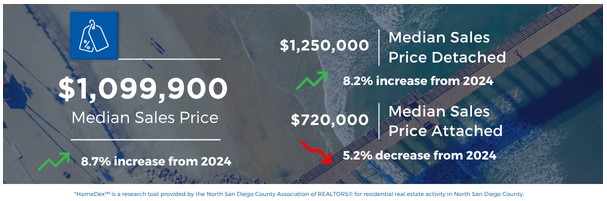

• Comparative Market Analysis (CMA): Analyze recent sales of similar homes in your San Diego neighborhood using Zillow, Redfin, or public records. Prices vary widely (e.g., $600,000 in Chula Vista vs. $2M+ in La Jolla).

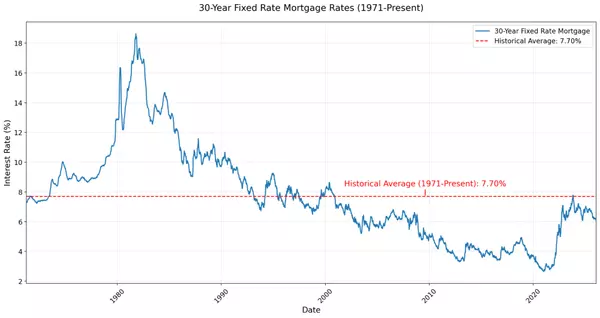

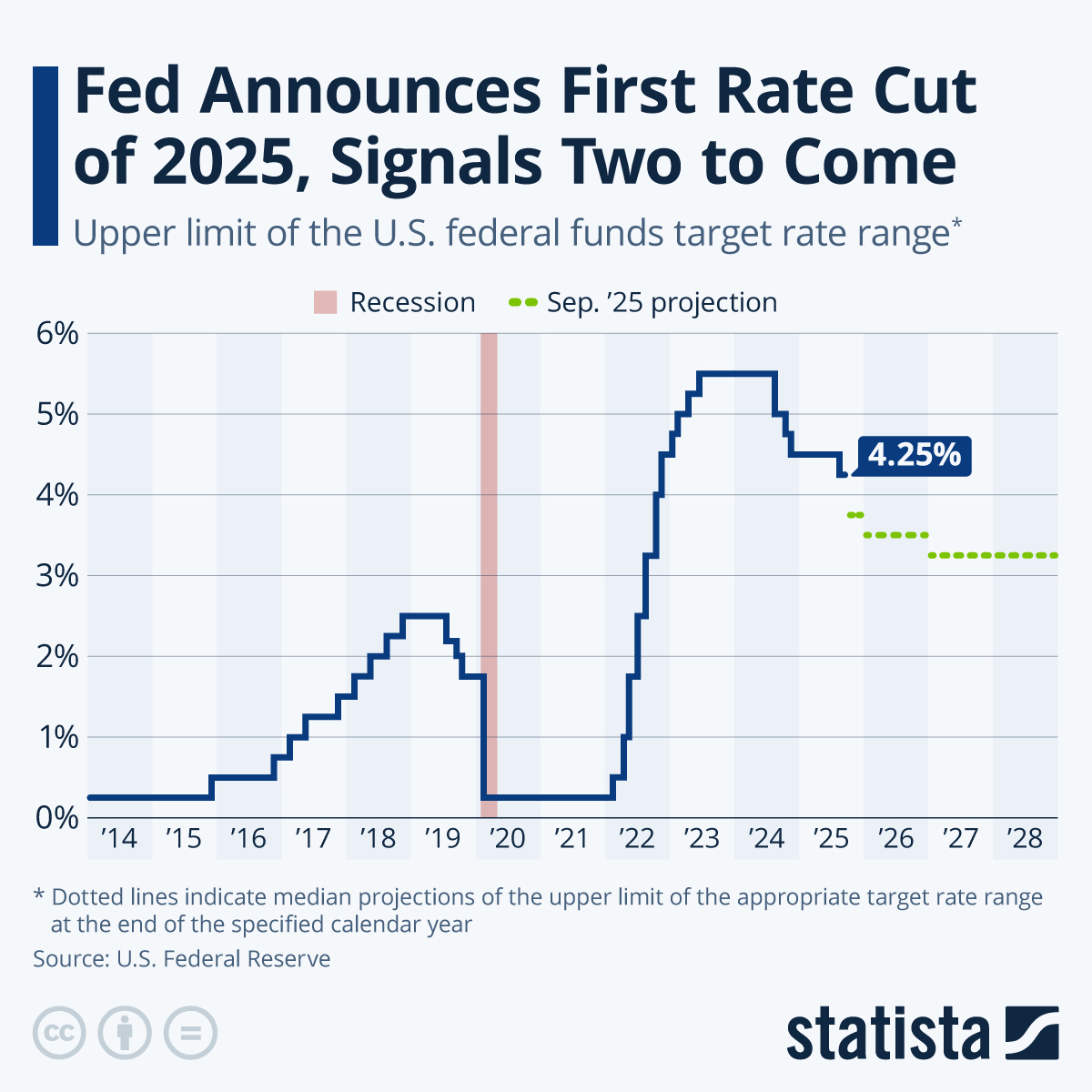

• Market Trends: Determine if it’s a buyer’s or seller’s market to time your listing strategically.

• Objective Pricing: Base your price on market data, not emotional attachment or financial needs.

Challenge: Without MLS access, obtaining accurate comps is challenging. Mispricing can lead to low offers or prolonged market time.

Step 3: Listing Your Home

Visibility is key to reaching potential buyers.

• Online Platforms: List on Zillow, FSBO.com, or Craigslist ($100–$400 in fees). These platforms offer limited reach compared to the Multiple Listing Service (MLS).

• MLS Access: Use a flat-fee MLS service ($300–$1,000) to appear on Realtor.com, Redfin, and agent databases, though you’ll manage inquiries and showings.

• Signage and Flyers: Purchase a professional “For Sale” sign ($50–$200) and print detailed flyers ($50–$150 for design and printing).

Challenge: Non-MLS listings miss the extensive exposure of agent-driven platforms, reducing buyer interest and potentially delaying your sale.

Step 4: Marketing Your Home

Strategic marketing helps your home shine in San Diego’s crowded market.

• Social Media: Promote your listing on Facebook, Instagram, and Nextdoor. Paid ads ($50–$200) can boost visibility but require targeting expertise.

• Traditional Open Houses: Host open houses on weekends, requiring signage ($50–$150 for directional signs and banners), refreshments ($50–$100 per event), and promotional materials like brochures ($50–$100). Traditional open houses take 4–8 hours each.

• Virtual Tours: Leverage the virtual tour from prep to attract remote or busy buyers.

Challenge: You’ll need to master digital marketing, respond to inquiries promptly, and manage open house logistics while juggling daily life. Weak marketing can make your home seem less desirable.

Step 5: Showing Your Home

Showings are your opportunity to impress, but they demand flexibility and caution.

• Scheduling: Be available for showings, often on short notice, as buyers expect accessibility. Anticipate 10–20 showings over weeks.

• Safety: Screen visitors by collecting names and contact info, and consider having someone present for security.

• Presentation: Keep your home pristine, leave during showings, and highlight features like proximity to San Diego’s beaches or energy-efficient upgrades.

Challenge: Showings disrupt your routine, and FSBO listings often attract investors and unqualified buyers. Learning to weed them out quickly is critical.

Step 6: Qualifying Buyers

Verify that buyers are financially capable to avoid wasted time.

• Pre-Approval Letters: Require lender pre-approval letters to confirm financial readiness.

• Cash Buyers: Verify funds with bank statements for cash offers.

• Loan Knowledge: Understand loan types (e.g., FHA, VA) to evaluate buyer reliability.

• Weeding Out Unqualified Buyers: FSBO listings often draw investors and unqualified buyers looking for bargains. Be prepared to quickly identify and dismiss those who lack financing or offer unrealistic terms.

Challenge: Misjudging a buyer’s qualifications can lead to a failed sale after weeks in escrow, forcing you to restart. Sorting through unqualified inquiries requires time and discernment.

Step 7: Negotiating Offers

Negotiation shapes your final sale price and terms, but FSBO sellers face unique pressures.

• Offer Evaluation: Review price, contingencies (e.g., inspection, appraisal), and closing timeline. Buyers may request repairs or credits.

• Counteroffers: Draft legally sound counteroffers, possibly hiring an attorney ($200–$500) to avoid mistakes.

• Agent Interactions: Many buyers use agents who expect professional communication and may push for concessions.

• Unrepresented Buyers: Buyers without agents often expect a discount, knowing you’re not paying a listing agent’s commission. They may argue that commissions are effectively paid by the buyer’s funds at closing. For example, if your home would sell for $1,000,000 with agents (including 5–6% commissions), unrepresented buyers may expect to pay $900,000–$950,000—or even lowball further, assuming you’re desperate to save on fees. Investors, in particular, may offer significantly less, hoping to capitalize on your lack of agent support.

Challenge: Without negotiation experience, you risk accepting lowball offers or losing buyers over minor terms. Unrepresented buyers and investors can be aggressive, and you’ll need to stand firm while weeding out unrealistic offers.

Step 8: Paying Buyer Agent Commissions

Even as a FSBO, you may need to pay a buyer’s agent.

• Standard Commissions: San Diego buyer agents typically expect 2–3% of the sale price ($16,000–$24,000 on an $800,000 home).

• Negotiation: Offering less may deter agents from showing your home.

• Unrepresented Buyer Expectations: As noted, buyers without agents often expect you to lower the price to reflect the absence of commissions, even though the buyer’s funds technically cover all closing costs, including commissions, in a traditional sale.

Challenge: Refusing to pay a buyer’s agent commission limits your buyer pool, as most buyers rely on agents who prioritize MLS listings with standard commissions. Meanwhile, unrepresented buyers may pressure you to reduce the price significantly.

Step 9: Navigating Escrow and Closing

Escrow involves complex legal and financial steps.

• Escrow Company: Hire an escrow company ($1,000–$2,000) to manage funds and paperwork.

• Title Insurance: Purchase title insurance ($1,500–$3,000) to protect against ownership disputes. A title company clears liens or issues.

• Disclosures: Complete California-required disclosures (e.g., natural hazards, lead paint) accurately to avoid lawsuits.

• Inspections and Appraisals: Buyers may request inspections ($300–$600) or appraisals ($500–$800). Negotiate repairs or credits if issues arise.

• Closing Documents: Review and sign extensive paperwork, ensuring compliance with California law.

Challenge: Errors in disclosures or escrow can delay closing or spark legal issues. Coordinating multiple parties without an agent is time-consuming and stressful.

Step 10: Closing and Transferring Ownership

Finalize the sale and transfer ownership.

• Final Walkthrough: Buyers inspect the home to confirm its condition.

• Funds and Keys: Escrow releases funds, you deliver keys, and vacate.

• Tax Implications: Consult a CPA to address capital gains tax or other obligations.

Challenge: Last-minute disputes (e.g., repair issues) can derail closing, requiring swift resolution under pressure.

The FSBO Reality: Is It Worth It?

Selling FSBO in San Diego demands:

• Time: 100+ hours managing prep, marketing, showings, negotiations, and escrow.

• Money: $3,750–$11,250 in fees (photography, virtual tours, signage, open house expenses, MLS, escrow, etc.).

• Expertise: Proficiency in pricing, marketing, negotiation, and legal processes.

• Stress: Navigating lowball offers, unqualified buyers, investors, and potential deal failures.

While you may save a listing agent’s commission (2.5–3%), FSBO homes in San Diego sell for 8–10% less than agent-listed homes, often negating savings. Unrepresented buyers expecting discounts and aggressive investors can further erode your profits. Mistakes in pricing, negotiation, or legal steps can cost even more.

Our Solution: “Sell Your Home Yourself, While It’s Listed, and Pay Zero Commission*” Program

At Abundant Path Homes, we’ve created a program that combines FSBO flexibility with professional support:

• Stay in Control: List with us but find your own buyer (e.g., a friend or neighbor) and pay zero commission to us*.

• Maximum Exposure: We list your home on the MLS, reaching thousands of buyers and agents, with professional photography, virtual tours, and marketing—all handled by us.

• We Handle the Work: We manage showings, qualify buyers, negotiate offers, and navigate escrow, shielding you from lowball offers and unqualified buyers.

• Risk-Free Guarantee: Cancel your listing anytime, and you’ll only cover the cost of photos, virtual tours, and marketing that we have funded, no hassle.

• Higher Profits: Our homes sell for an average of 8.35% more than local FSBOs, often exceeding commission costs, thanks to our pricing and negotiation expertise.

To Learn More about the details of this offer click here

*Terms and Conditions apply

Categories

Recent Posts